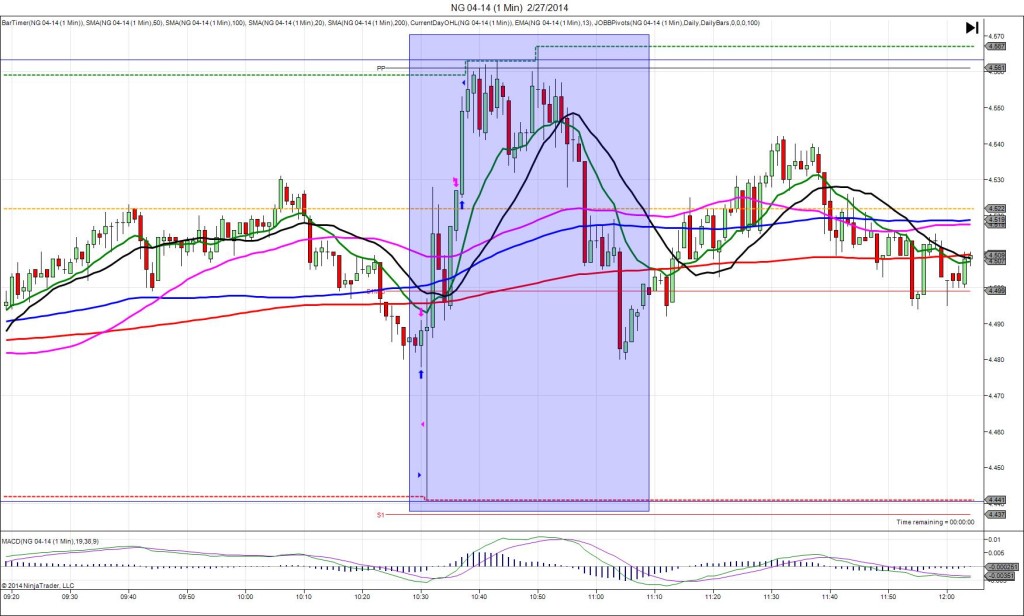

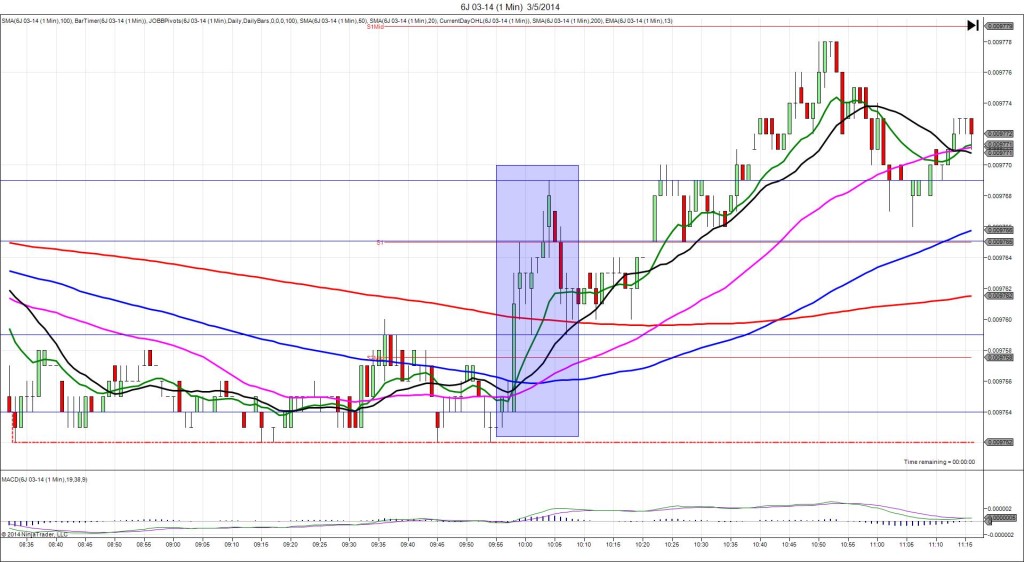

2/27/2014 Weekly Natural Gas Storage Report (1030 EST)

Forecast: -110B

Actual: -95B

INDECISIVE

Started @ 4.484 (1029)

1st Peak @ 4.441 – 1031 (1 min)

43 ticks

Reversal to 4.497 – 1031 (1 min)

56 ticks

Extended Reversal to 4.563 – 1038 (8 min)

122 ticks

Notes: Smaller draw on the reserve compared to the forecast saw a moderate short move while the action of the :30 bar would have been easily contained within the bracket. With JOBB, you would have filled short at 4.460 with 14 ticks slippage on the :31 bar, then seen it hit the LOD and promptly retreat to the fill point and hover for 5 sec before retreating further long. When it hovers in that manner with a big pullback, the best course of action is to exit quickly near breakeven. The :31 bar reversed all the way up to the 200 SMA then the extended reversal climbed all the way up to 4.563 for 122 ticks in 8 min. After that it chopped between the 13 SMA and PP Pivot before falling to the area of support seen before the news broke.