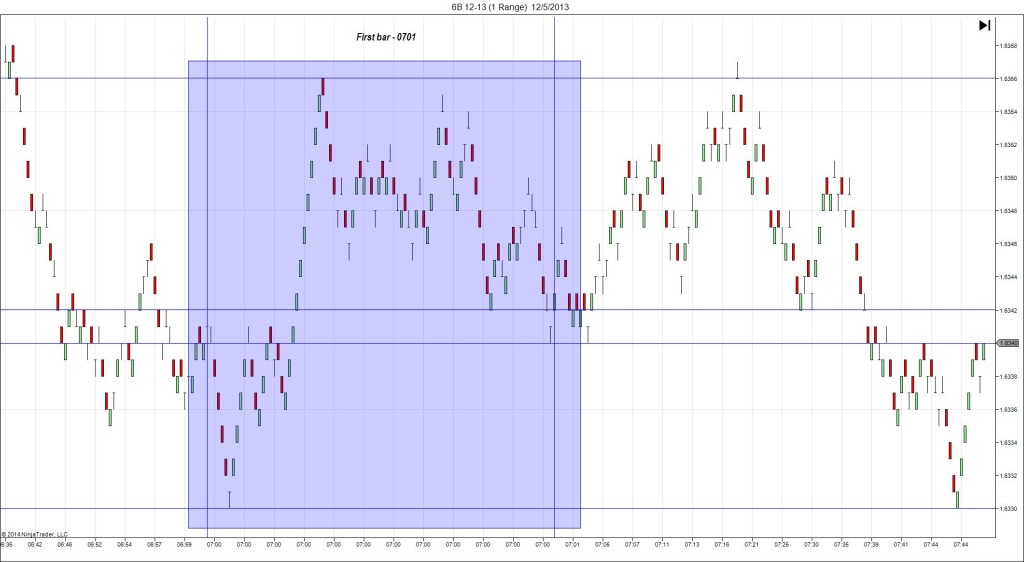

3/5/2014 GBP Services PMI (0428 EST)

Forecast: 58.0

Actual: 58.2

TRAP TRADE (DULL REACTION)

Anchor Point @ 1.6671 (last price)

————

Trap Trade:

)))1st Peak @ 1.6680 – 0427:54 (0 min)

)))9 ticks

)))Reversal to 1.6663 – 0428:02 (1 min)

)))-17 ticks

)))Pullback to 1.6678 – 0428:15 (1 min)

)))15 ticks

————

2nd Peak @ 1.6692 – 0432 (4 min)

21 ticks

Reversal to 1.6669 – 0449 (21 min)

23 ticks

Trap Trade Bracket setup:

Long entries – 1.6653 (just below the LOD) / 1.6635 (just above the S2 Mid Pivot)

Short entries – 1.6693 (on the HOD) / 1.6706 (No SMA/ Pivot nearby)

Notes: Report came in nearly matching with a narrow offset of +0.2 causing a premature long impulse for 9 ticks as it eclipsed the 50 SMA. Then it reversed 8 sec later 17 ticks to cross the 200 SMA and nearly reach the S1 Mid Pivot. All of this movement would have been well inside the 20 tick inner tiers, so cancel the order. After 15 sec it pulled back to the 100 SMA, then eventually achieved a 2nd peak of 12 more ticks on the :02 bar as it nearly reached the HOD. Then it fell 23 ticks in the next 21 min to cross the 200 SMA. After that, it continued to cycle between the R1 Mid Pivot and S1 Mid Pivot 2 more times as it gradually trended lower.