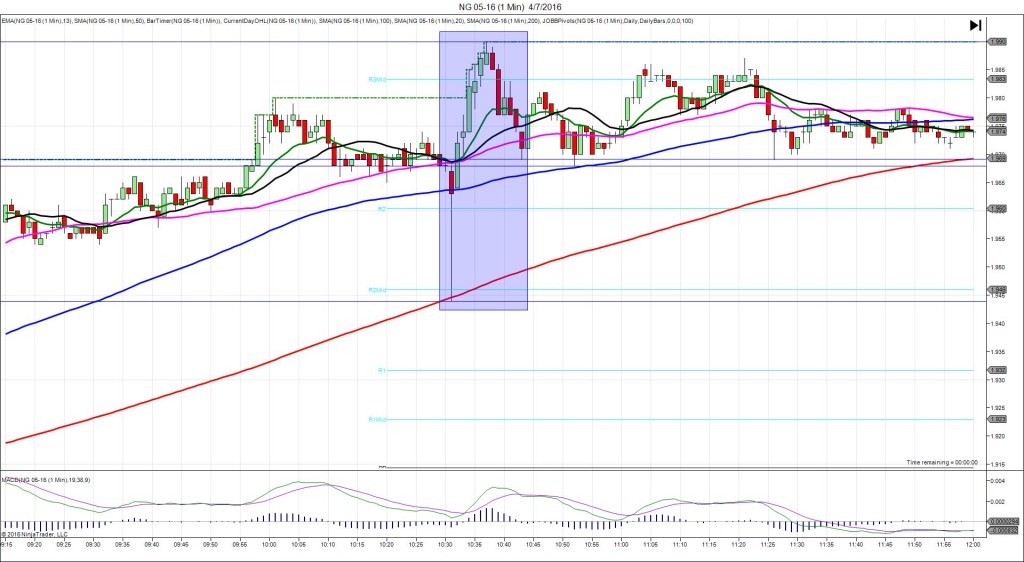

4/7/2016 Weekly Natural Gas Storage Report (1030 EDT)

Forecast: 7B

Actual: 12B

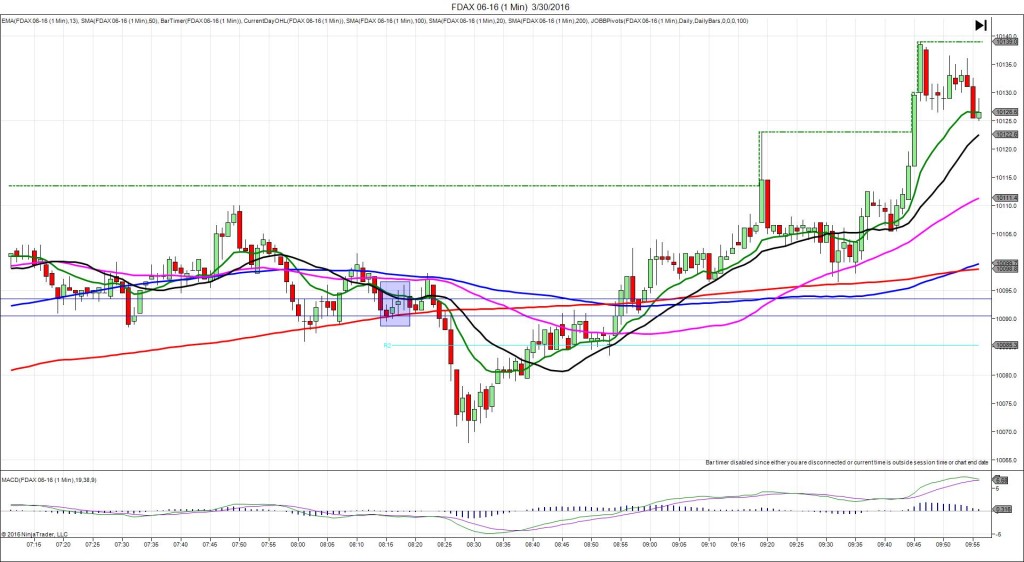

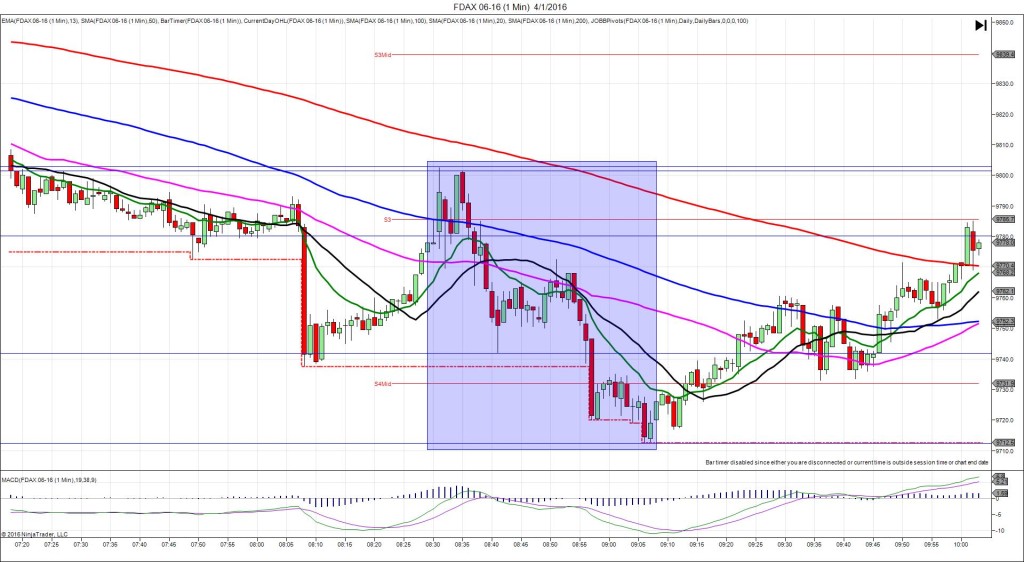

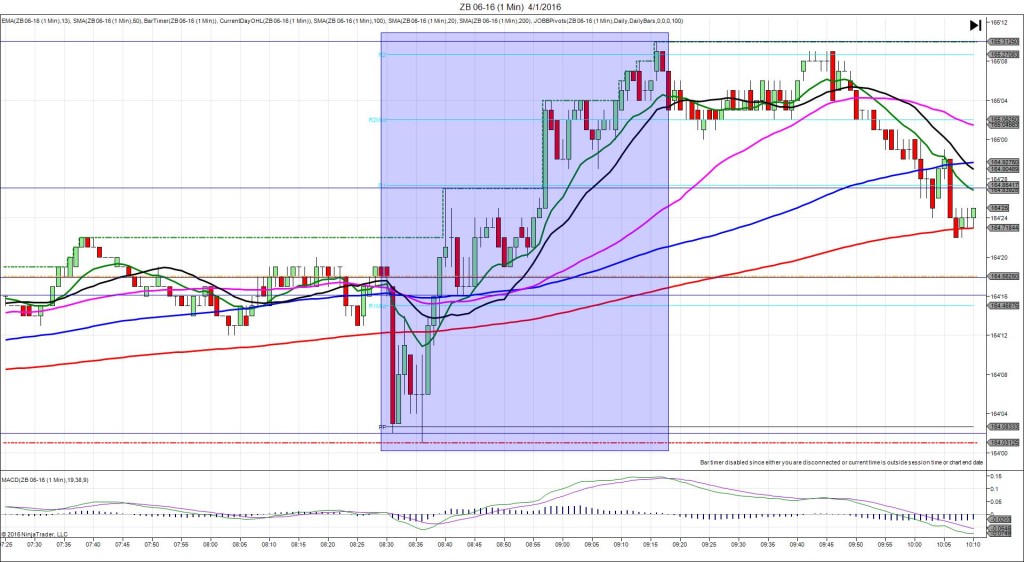

SPIKE / REVERSE

Started @ 1.968

1st Peak @ 1.944 – 1030:00 (1 min)

24 ticks

Reversal to 1.990 – 1037 (7 min)

46 ticks

Pullback to 1.969 – 1043 (13 min)

21 ticks

Expected Fill: 1.956 (short)

Slippage: 2 ticks

Best Initial Exit: 1.953 – 3 ticks

Recommended Profit Target placement: 1.945 (in between the R2 Mid Pivot and 200 SMA)

Notes: Short spike hit the 200 SMA / R2 Mid Pivot and recoiled instantly. Even a profit target would not have been setup in time. Look to exit with a few ticks as it was in an overall uptrend and crossed several layers of support in the move. Nice reversal to eclipse the R3 Mid Pivot and extend the HOD.