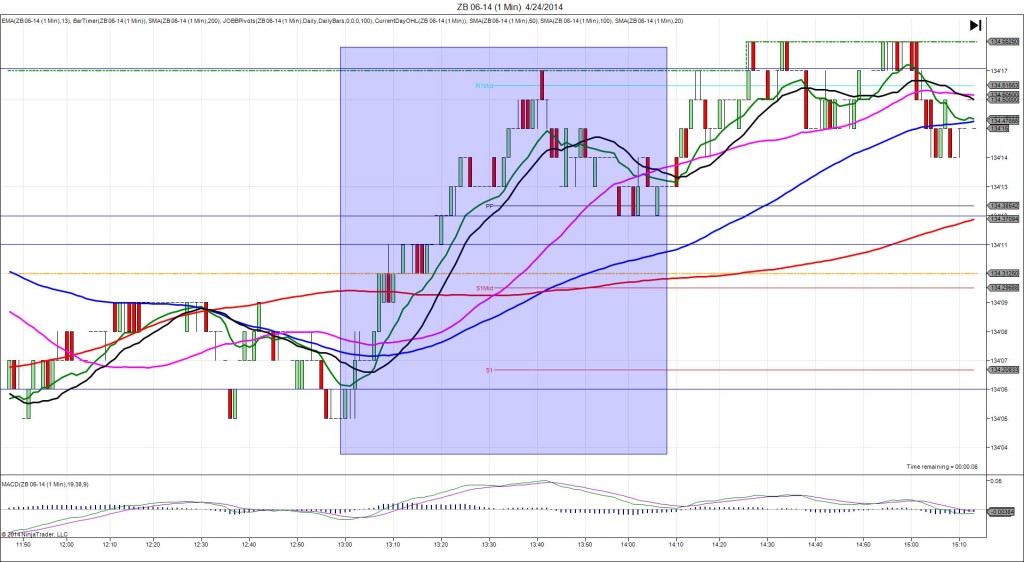

3/30/2016 7-yr Bond Auction (1301 EDT)

Previous: 1.57/2.3

Actual: 1.61/2.5

DULL FILL…SPIKE WITH 2ND PEAK

Started @ 163’07 (1301)

1st Peak @ 163’10 – 1302:29 (1 min)

3 ticks

Final Peak @ 163’28 – 1324 (23 min)

21 ticks

Reversal to 163’04 – 1354 (53 min)

24 ticks

Expected Fill: 163’09 (long)

Slippage: 0 ticks

Best Initial Exit: 163’10 – 1 tick

Recommended Profit Target placement: 163’15 (just below the S2 Mid Pivot) – move lower

Notes: Slow and dull initially. You may have cancelled the orders as it would not have filled the long bracket until 1302:24. If filled, it would have sat on the fill point or 1 tick profit for 2 min before climbing for another 18 ticks in 20 min to the S1 Pivot. Then it reversed 24 ticks in 30 min to the 200 SMA / S2 Pivot area.