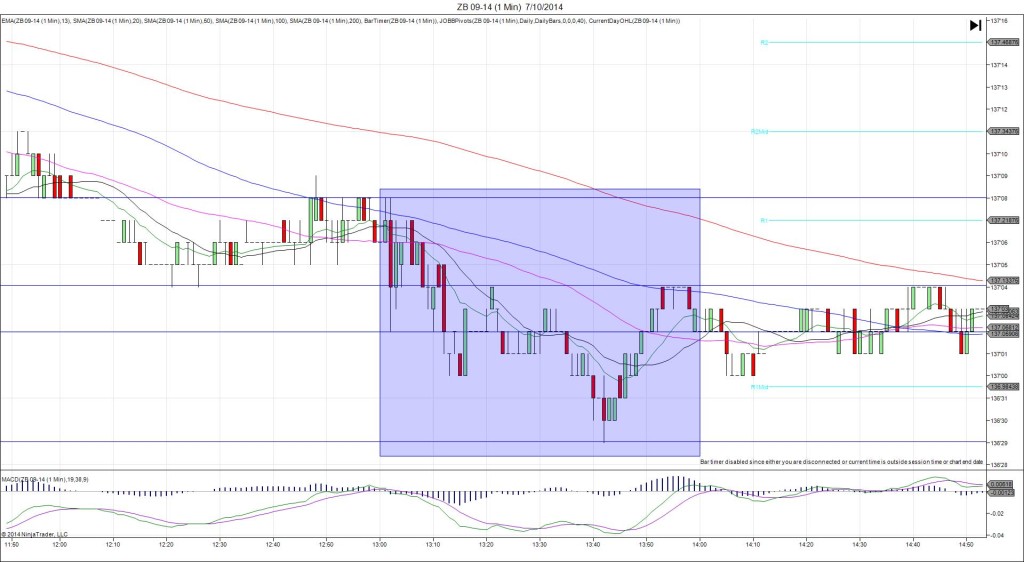

6/11/2014 10-yr Bond Auction (1301 EDT)

Previous: 2.61/2.6

Actual: 2.65/2.9

TRAP TRADE (SPIKE WITH 2ND PEAK)

Anchor Point @ 135’01 (1301)

————

Trap Trade:

)))1st Peak @ 134’28 – 1301:37 (1 min)

)))-5 ticks

)))Reversal to 134’31 – 1301:40 (1 min)

)))3 ticks

————

2nd Peak @ 134’24 – 1306 (5 min)

9 ticks

Reversal to 134’30 – 1311 (10 min)

6 ticks

Double Bottom @ 134’24 – 1336 (35 min)

6 ticks

Reversal to 135’05 – 1424 (83 min)

13 ticks

Trap Trade Bracket setup:

Long entries – 134’28 (just above the S1 Mid Pivot) / 134’25 (in between the S1 Mid Pivot and OOD)

Short entries – 135’05 (just above the R1 Pivot) / 135’08 (just above the R2 Mid Pivot)

Notes: Report is scheduled on Forex Factory at the top of the hour, but the spike always breaks 1 min late. The highest yield rose a bit from last month’s auction. This caused the ZB to pop short for 5 ticks, then quickly back off for 3 ticks after 3 sec, then fall again. This would have filled the inner tier then hovered near the fill point for 3 min. In this case, you can exit near breakeven, or wait it out with the outer tier still on the board in case of a 2nd peak and follow on reversal. As it fell later, it would have filled the outer long entry then rebounded allowing 5-7 total ticks on both fills to be captured. Then it made a double bottom and reversed for 13 ticks nearly 1.5 hrs after the auction.