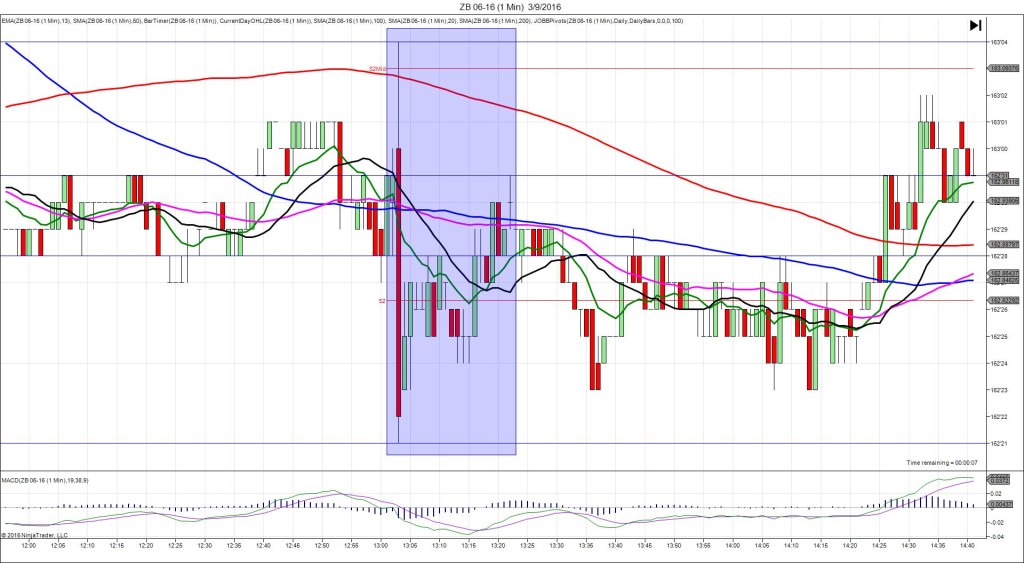

4/13/2016 10-yr Bond Auction (1301 EDT)

Previous: 1.90/2.5

Actual: 1.77/2.8

SPIKE WITH 2ND PEAK

Started @ 165’13 (1301)

1st Peak @ 165’21 – 1302:14 (1 min)

8 ticks

2nd Peak @ 165’23 – 1305 (4 min)

10 ticks

Reversal to 165’19 – 1308 (7 min)

4 ticks

Final Peak @ 165’28 – 1319 (18 min)

15 ticks

Reversal to 165’23 – 1340 (39 min)

5 ticks

Expected Fill: 165’15 (long)

Slippage: 0 ticks

Best Initial Exit: 165’21 – 6 ticks

Recommended Profit Target placement: 165’18 (just above the 50 SMA) and 165’22 (just above the R1 Pivot)

Notes: Slow moving initially, but it turned into a nice spike of 8 ticks as it popped just before the :02 bar expired. This would have allowed up to 6 ticks to be captured when it stalled below the R1 Pivot. It achieved 2 more ticks before a 4 tick reversal and then climbed for a final peak as it rode the 13 SMA upward for another 5 ticks.