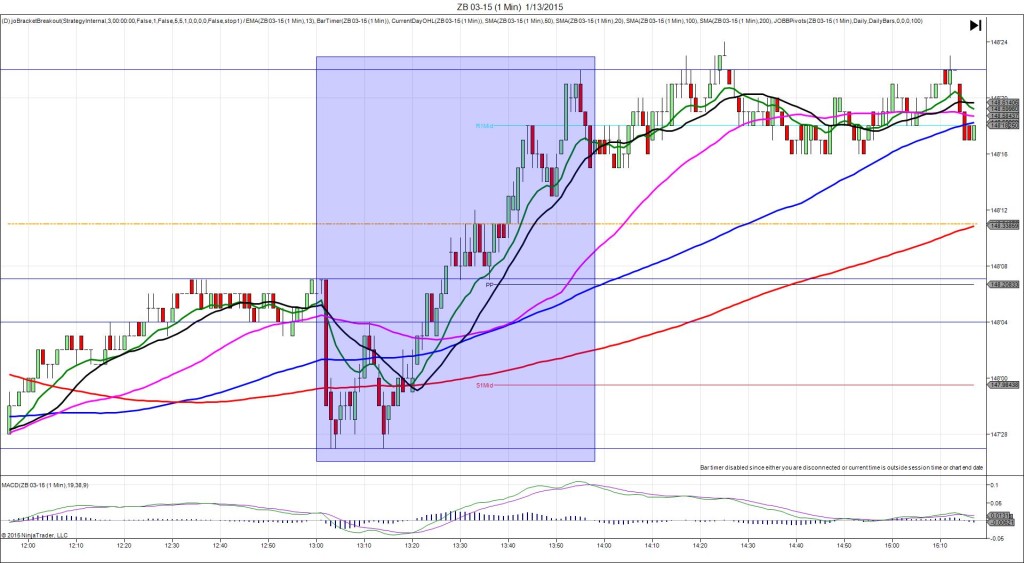

1/13/2015 10-yr Bond Auction (1301 EST)

Previous: 2.21/3.0

Actual: 1.93/2.6

TRAP TRADE – OUTER TIER DULL FILL

Anchor Point @ 148’07 (1301)

————

Trap Trade:

)))1st Peak @ 147’27 – 1302:12 (2 min)

)))-12 ticks

)))Reversal to 147’31 – 1304:52 (4 min)

)))4 ticks

————

Continued Reversal to 148’04 – 1311 (10 min)

9 ticks

Pullback to 147’27 – 1314 (13 min)

9 ticks

Reversal to 148’22 – 1355 (54 min)

27 ticks

Trap Trade Bracket setup:

Long entries – 148’02 (just below the 100 SMA) / 147’31 (just below the 200 SMA / S1 Mid Pivot)

Short entries – 148’12 (just above the OOD) / 148’15 (no SMA / Pivot near)

Notes: Report is scheduled on Forex Factory at the top of the hour, but the spike always breaks 1 min late. The highest yield fell very strongly from last month’s auction. This caused the ZB to pop short for a large move of 12 ticks to cross the 200 SMA / S1 Pivot. This would have filled both tiers of your long entries for an average long position of 148’00.5. Then it reversed 4 ticks in 2 min to the outer tier position and another 5 ticks in the next 6 min to the 50 SMA. Due to the crossing of the 200 SMA and S1 Mid Pivot and the size of the move, it would be a safe decision to be patient for a reversal to breakeven or a little profit. A quick exit would have yielded a loss of 3 total ticks, but a patient exit would have allowed up to 7 total ticks to be captured. After the reversal it pulled back for a double bottom in 3 min before reversing 27 ticks in 41 min to cross the R1 Mid Pivot.