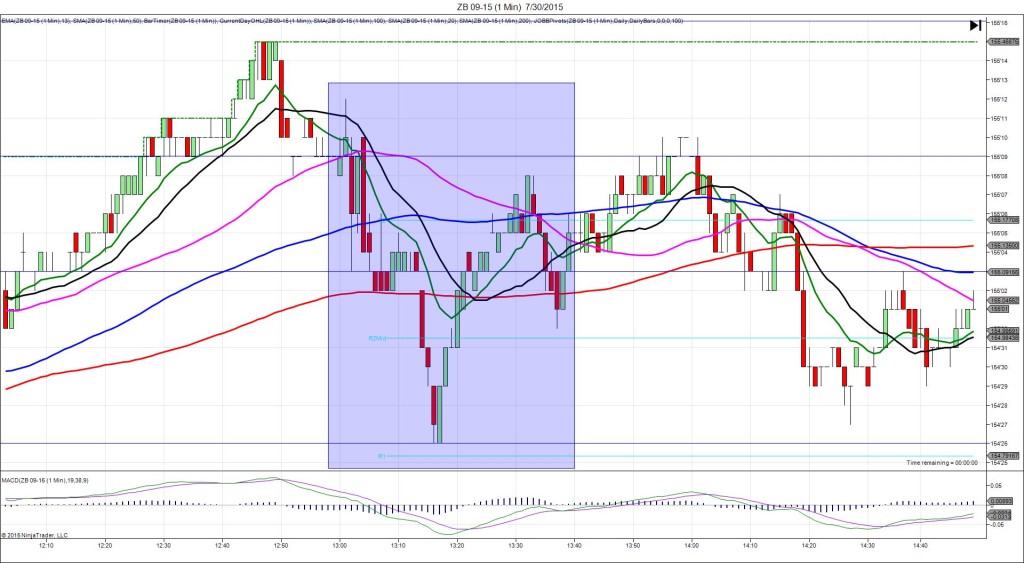

7/9/2015 30-yr Bond Auction (1301 EDT)

Previous: 3.14/2.5

Actual: 3.08/2.2

SPIKE WITH 2ND PEAK

Started @ 152’10 (1301:30)

1st Peak @ 151’28 – 1302:20 (2 min)

14 ticks

Reversal to 152’03 – 1308 (7 min)

7 ticks

2nd Peak @ 151’18 – 1326 (25 min)

24 ticks

Reversal to 151’26 – 1330 (29 min)

8 ticks

Notes: Report is scheduled on Forex Factory at the bottom of the hour, but the spike always breaks 1:30 late. The highest yield fell moderately from last month as the bid to cover also dropped. This caused the bonds to spike short for 14 ticks in about 70 sec as it crossed the S3 Mid Pivot. With JOBB you would have filled short at 152’05 with 2 ticks of slippage, then seen it continue to drop and trickle down to hover around 151’29 to allow about 8 ticks to be captured. After that it reversed 7 ticks in 5 min to the S3 Mid Pivot / 13 SMA before falling for a 2nd peak of 10 more ticks in 18 min. Then it reversed 8 ticks in 4 min to the 13 SMA.