1/9/2014 30-yr Bond Auction (1301 EST)

Previous: 3.90/2.4

Actual: 3.90/2.6

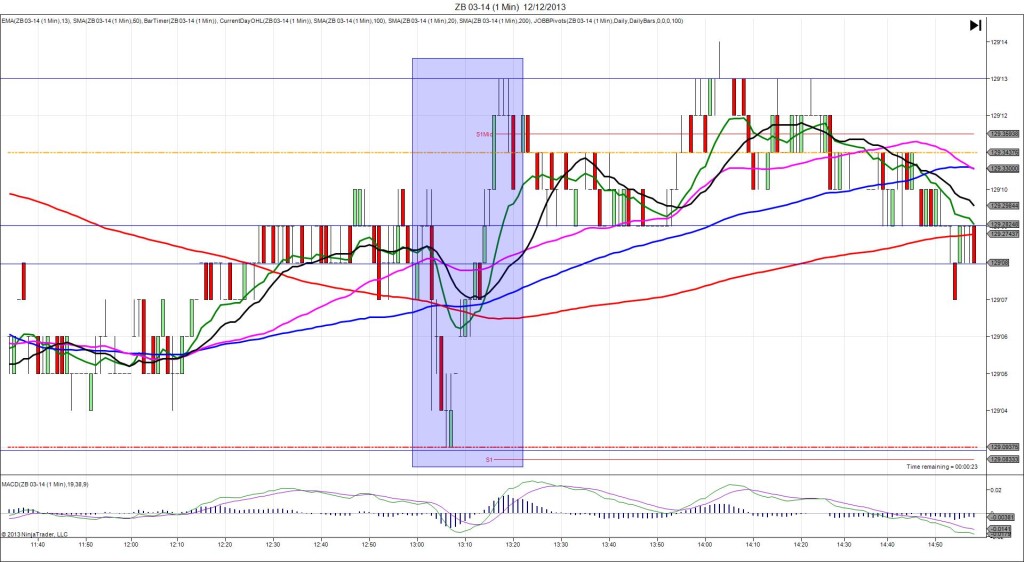

SPIKE WITH 2ND PEAK

Started @ 129’00 (1301)

1st Peak @ 129’06 – 1303 (2 min)

6 ticks

2nd Peak @ 129’10 – 1310 (9 min)

10 ticks

Reversal to 129’04 – 1337 (36 min)

6 ticks

Notes: Report is scheduled on Forex Factory at the bottom of the hour, but the spike always breaks 1 min late. The highest yield rose stayed the same from last month but the bid to cover ratio was slightly higher signifying greater demand. This caused the bonds to rally for 6 ticks as it started just above the R1 Pivot and crossed the 200 SMA and R2 Pivot. With JOBB you would have filled long at 129’02 with no slippage, then had an opportunity to capture about 3-4 ticks if you were patient. With the R2 Pivot at 129’05, a target there or 1 tick higher would have been ideal. It continued to rise for 4 more ticks in the next 7 min, then it reversed for 6 ticks back to the 50 SMA and R2 Pivot in the next 27 min.