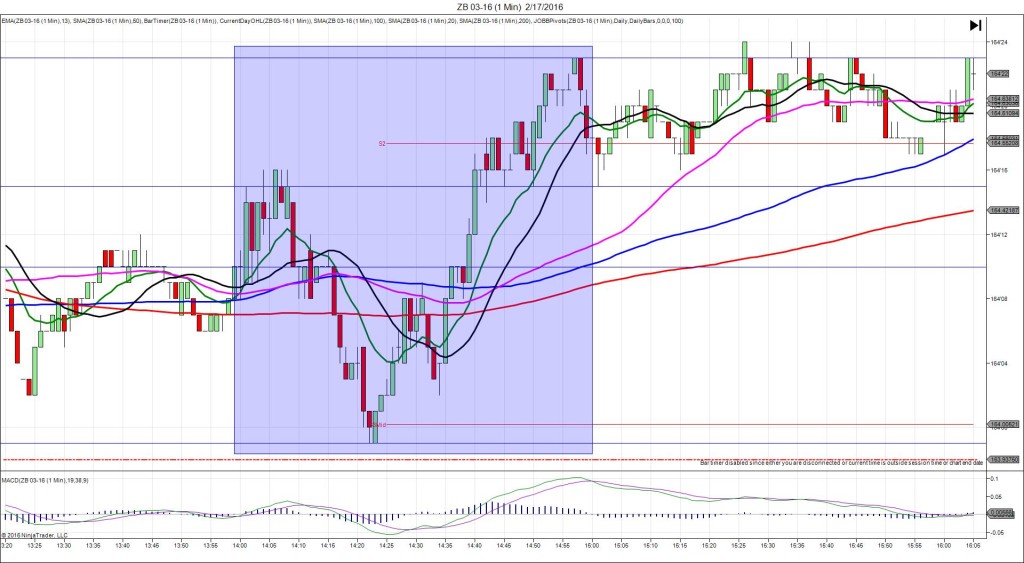

3/16/2016 FOMC Statement / FED Funds Rate (1400 EDT)

Forecast: n/a

Actual: n/a

TRAP TRADE – OUTER TIER

Anchor Point @ 161’05

————

Trap Trade:

)))1st Peak @ 161’23 – 1400:00 (1 min)

)))18 ticks

)))Reversal to 161’07 – 1400:05 (1 min)

)))-16 ticks

)))Pullback to 161’24 – 1400:12 (1 min)

)))17 ticks

)))Reversal to 161’12 – 1400:51 (1 min)

)))12 ticks

————

2nd Peak @ 162’07 – 1409 (9 min)

34 ticks

Reversal to 161’02 – 1446 (46 min)

37 ticks

Pullback to 161’27 – 1516 (76 min)

25 ticks

Trap Trade Bracket setup:

Long entries – 160’30 (in between the S1 and S2 Mid Pivots) / 160’22 (just below the S2 Mid Pivot)

Short entries – 161’13 (on the 200 SMA) / 161’21 (No SMA / Pivot near)

Expected Fill: 161’13 and 161’21 – both short tiers

Best Initial Exit: 161’07 – 16 ticks (if quick) or 161’12 – 10 ticks

Recommended Profit Target placement: 161’07 (on the 50 SMA) – move higher

Notes: Both short tiers would have filled for an average short position of 161’17. Then it stabbed lower offering 16 total ticks for about 3 sec, pulled back to the peak and reversed again to almost the same area offering 8-10 total ticks where it hovered for about 20 sec. After that it climbed for a 2nd peak of 16 more ticks in 8 min to the HOD / R1 Mid Pivot before a 37 ticks reversal that stepped down to the S1 Pivot / LOD.