5/10/2013 FED Chairman Bernanke Speech (0930 EDT)

Forecast: n/a

Actual: n/a

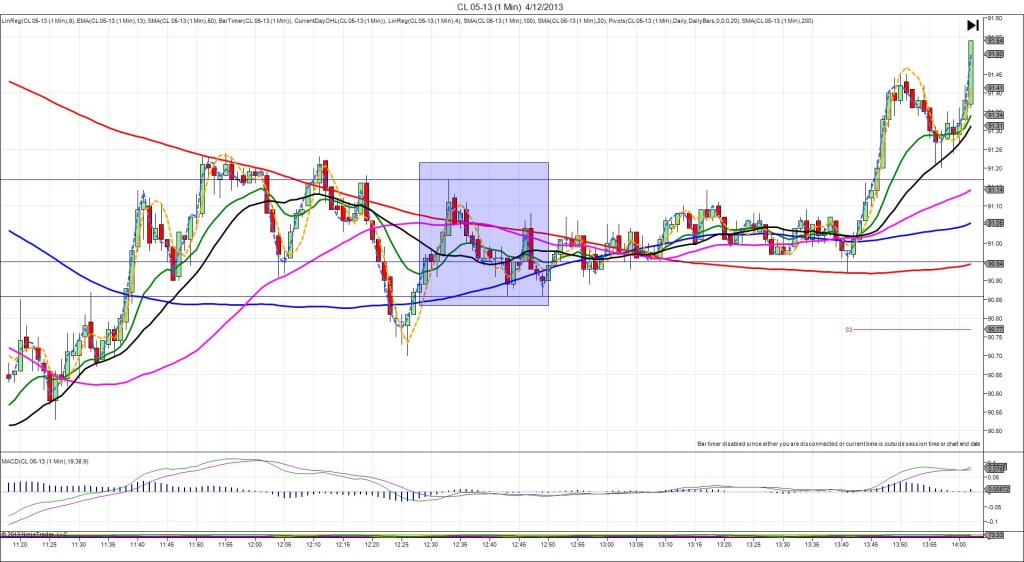

SPIKE/REVERSE

Started @ 94.20

1st Peak @ 94.09 – 0932 (2 min)

11 ticks

Reversal to 94.44 – 0950 (20 min)

35 ticks

2nd Peak @ 93.37 – 1054 (84 min)

83 ticks

Reversal to 94.08 – 1115 (105 min)

71 ticks

Notes: FED Chair Bernanke spoke before the Federal Reserve Bank’s 49th annual conference on Bank Structure and Competition in Chicago. He discussed and defended the FED policies in monitoring the financial system. With JOBB, you would have filled short at about 94.15 with no slippage on the :31 bar. Then it fell for only 11 ticks as the :31-:33 bars found support at 94.09. With the market having trended lower about 70 ticks in the previous 30 min and near the LOD, be wary of hanging around for a larger short move. After all 3 bars could not penetrate 94.09 and the LOD was looming only 8 ticks lower, look to exit at about breakeven on or around the 20 SMA. After the peak, we saw a reversal of 35 ticks in 20 min. After it collided with the 100 SMA, it fell again for a 2nd peak of 83 ticks in the next hr. Then it reversed for 71 ticks in about 20 min to nearly reach the 200 SMA.

-111512.jpg)

-100112.jpg)

-083112.jpg)

-080612.jpg)

-051012.jpg)