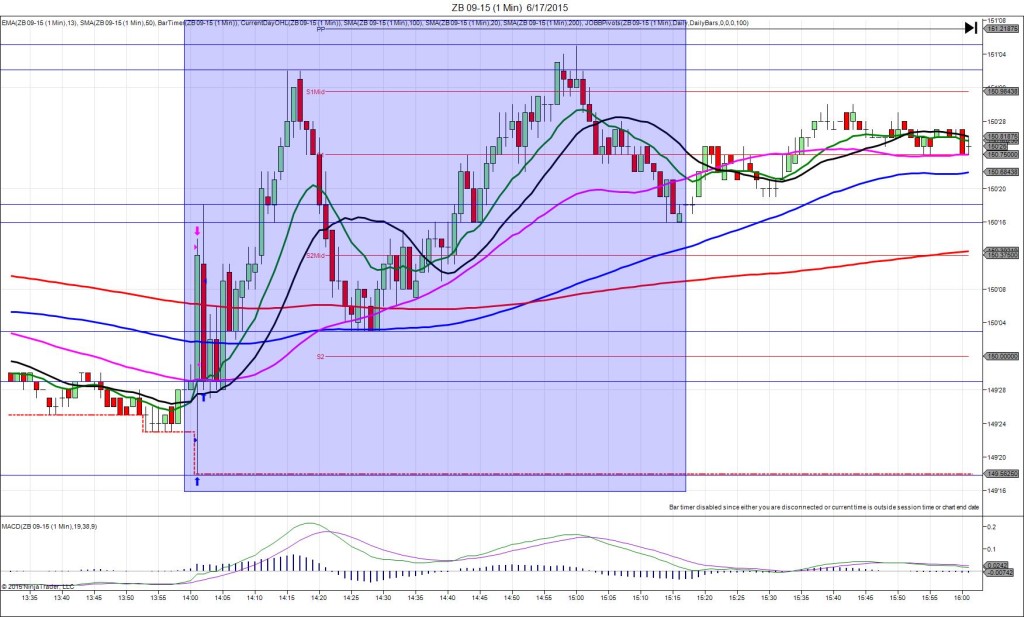

6/17/2015 FOMC Statement / FED Funds Rate (1400 EDT)

Forecast: n/a

Actual: n/a

TRAP TRADE – INNER TIER

Anchor Point @ 149’29

————

Trap Trade:

)))1st Peak @ 149’18 – 1400:23 (1 min)

)))-11 ticks

)))Reversal to 150’18 – 1401:10 (2 min)

)))32 ticks

)))Pullback to 149’27 – 1402:21 (3 min)

)))-23 ticks

————

Reversal to 151’02 – 1415 (15 min)

39 ticks

Pullback to 150’03 – 1425 (25 min)

31 ticks

Reversal to 151’05 – 1500 (60 min)

34 ticks

Pullback to 150’16 – 1514 (74 min)

21 ticks

Trap Trade Bracket setup:

Long entries – 149’22 (just below the LOD) / 149’13 (just above the S3 Mid Pivot)

Short entries – 150’05 (just below the 200 SMA) / 150’13 (just above the S2 Mid Pivot)

Notes: The FED deferred the option of a rate hike to September, but stated the economy was improving since the winter quarter. This caused the expected instability with an 11 tick short spike in 23 sec followed by the reversal. This would have filled the inner short entry at 8 sec. Then you would have seen it continue to fall another 4 ticks before reversing strongly for 32 ticks in about 45 sec to the S2 Mid Pivot. This would have allowed up to 26 ticks to be captured. After that it pulled back 23 ticks in about 70 sec to the 50 SMA before reversing 39 ticks in 12 min to the S1 Mid Pivot. Then it continued to swing as it fell 31 ticks in 10 min to the 3 major SMAs before reversing 34 ticks to nearly reach the PP Pivot in 35 min. Then it pulled back 21 ticks in 14 min after crossing the 50 SMA.