6/19/2013 FOMC Statement / FED Funds Rate (1400 EDT)

Forecast: n/a

Actual: n/a

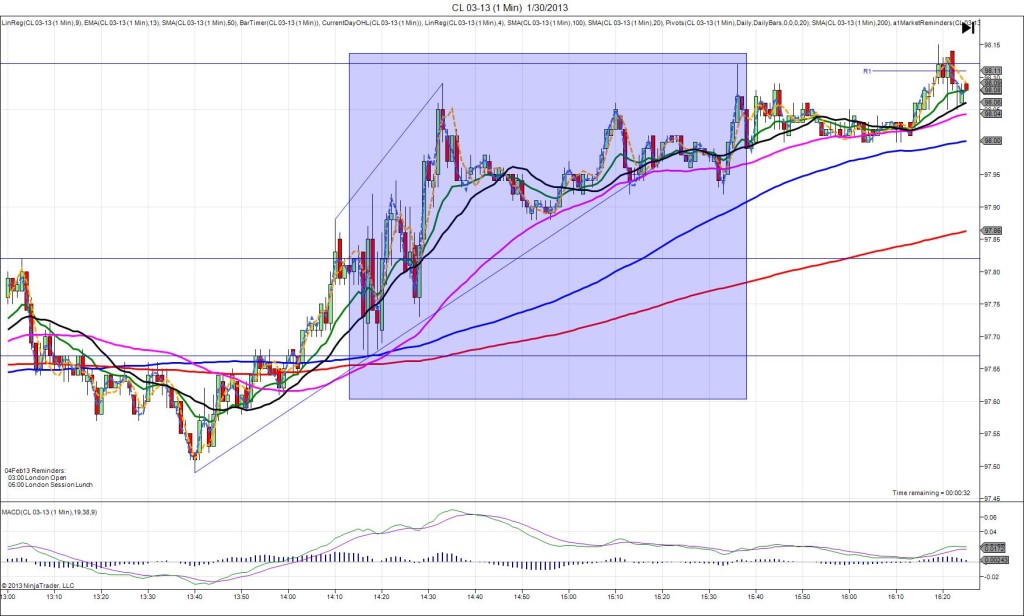

DOWNWARD FAN

Started @ 139’04 (1400)

Premature Spike @ 139’14 – 1401 (1 min)

10 ticks

1st Peak @ 138’22 – 1401 (1 min)

16 ticks

Final Peak @ 137’21 – 1455 (55 min)

49 ticks

Reversal to 138’04 – 1503 (63 min)

15 ticks

Notes: Report released on time, as the FED chose to continue the existing open ended QE3 policy despite seeing certain indications of improving economic conditions, but reiterated previous comments about tapering off the bond buying later in the year. This caused an initial long move that hit the PP Pivot and quickly reversed and turned into a downward fan as the demand for bonds was seen to be waning with QE3 being threatened to scale back. JOBB is not recommended for this report, but a short entry would have been advisable on the long retracement on the 1403 bar. Use the 50 SMA as the trail stop and/or look to exit after a sizeable 10+ tick move in a few min. It hit a climactic peak at 1455 just above the S3 Pivot for 49 ticks, then reversed for 15 ticks in 8 min. Since this was after the pit close and late in the trading day, additional trades would be discouraged, but it kept testing the LOD and then trended lower as volume and price action dried up.

-102412.jpg)

-091312.jpg)

-080112.jpg)

-062012.jpg)

-031312.jpg)

-012512.jpg)