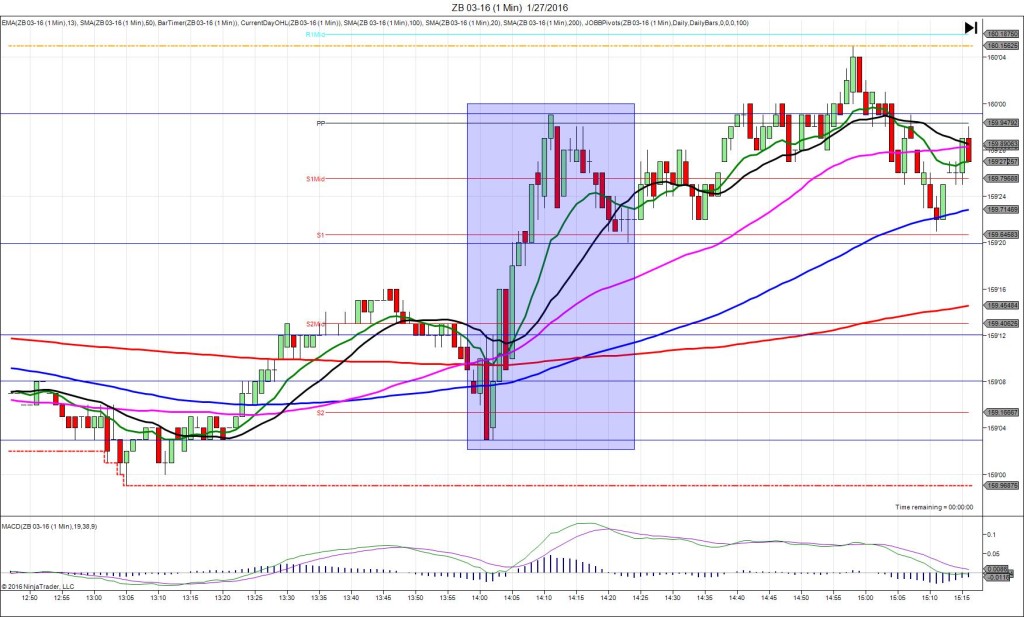

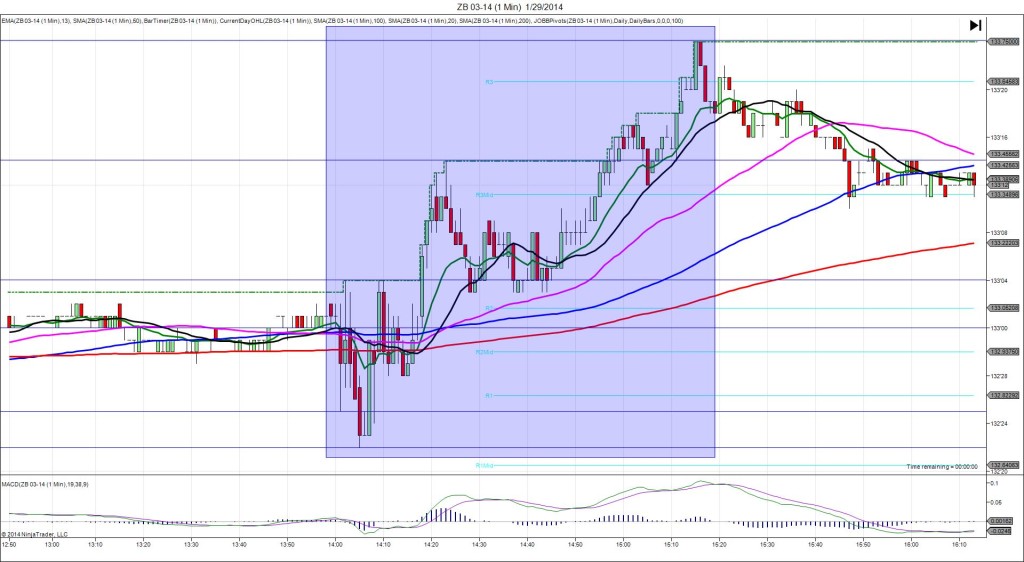

10/28/2015 FOMC Statement / FED Funds Rate (1400 EDT)

Forecast: n/a

Actual: n/a

TRAP TRADE – INNER TIER

Anchor Point @ 157’21 – shift 3 ticks lower to 157’18

————

Trap Trade:

)))1st Peak @ 157’08 – 1400:18 (1 min)

)))-10 ticks

)))Reversal to 157’23 – 1401:49 (2 min)

)))15 ticks

————

Pullback to 157’11 – 1404 (4 min)

12 ticks

Reversal to 157’25 – 1405 (5 min)

14 ticks

Pullback to 157’12 – 1411 (11 min)

13 ticks

Reversal to 158’07 – 1431 (31 min)

27 ticks

Trap Trade Bracket setup:

Long entries – 157’10 (in between the LOD / S3 Pivot) / 157’03 (No SMA / Pivot near)

Short entries – 157’26 (No SMA / Pivot near) / 158’04 (just above the S2 Mid Pivot)

Expected Fill: 157’10 (inner long tier)

Best Initial Exit: 157’22 – 12 ticks

Recommended Profit Target placement: 157’21 (on the 200 SMA)

Notes: As expected FOMC decided to wait to raise rates again to December. The inner long entry would have filled nicely then reversed to allow up to 12 ticks.