7/10/2013 FOMC Meeting Minutes (1400 EDT)

Forecast: n/a

Actual: n/a

Previous Revision: n/a

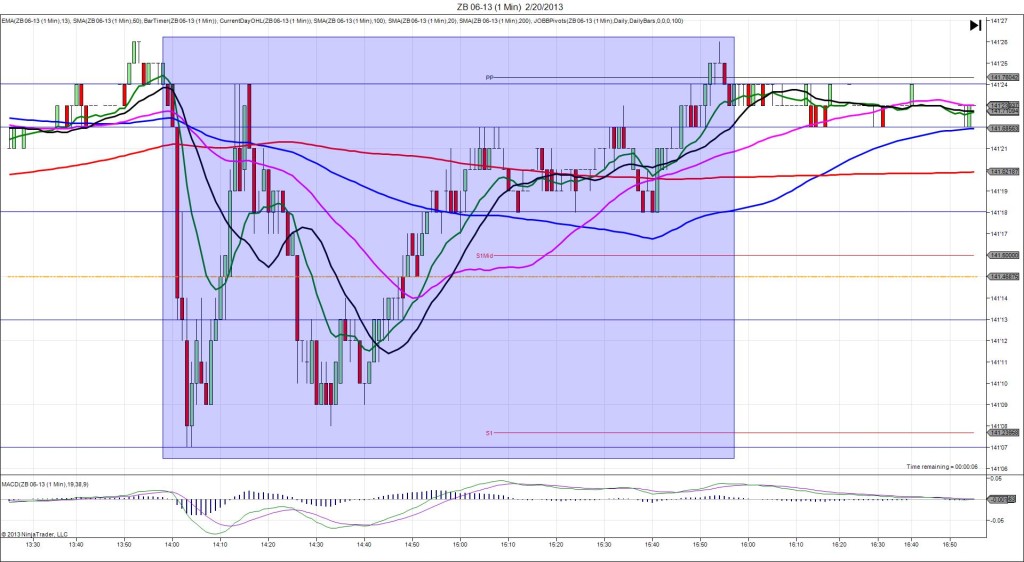

SPIKE WITH 2ND PEAK

Started @ 133’02

1st Peak @ 132’26 – 1401 (1 min)

8 ticks

Reversal to 133’18 – 1402 (2 min)

24 ticks

2nd Peak @ 132’21 – 1459 (59 min)

13 ticks

Reversal to 132’30 – 1525 (85 min)

9 ticks

Notes: About half of FED members felt that the bond buying program could be phased out by the end of 2013. Still, assurances were given that QE3 would not be halted in 2 months as initially feared. This caused the bonds to fall 8 ticks, hover for about 8 sec near the LOD, then reverse 24 ticks in the next 2 min to eclipse the PP Pivot and OOD. With JOBB you would have filled short at 133’00 with no slippage, then a 5 tick profit target would have filled. I had a 6 tick profit target with a breakeven setting of 4 ticks, so I was stopped with 0 ticks. The reaction is usually quick and shortly sustained, so a trap trade approach may be worthy too. After the strong reversal, it chopped up and down and eventually fell for a 2nd peak of 13 ticks nearly an hour after the report, reaching the S3 Mid Pivot. Then it reversed for 9 ticks in 26 min, crossing the 50 SMA.