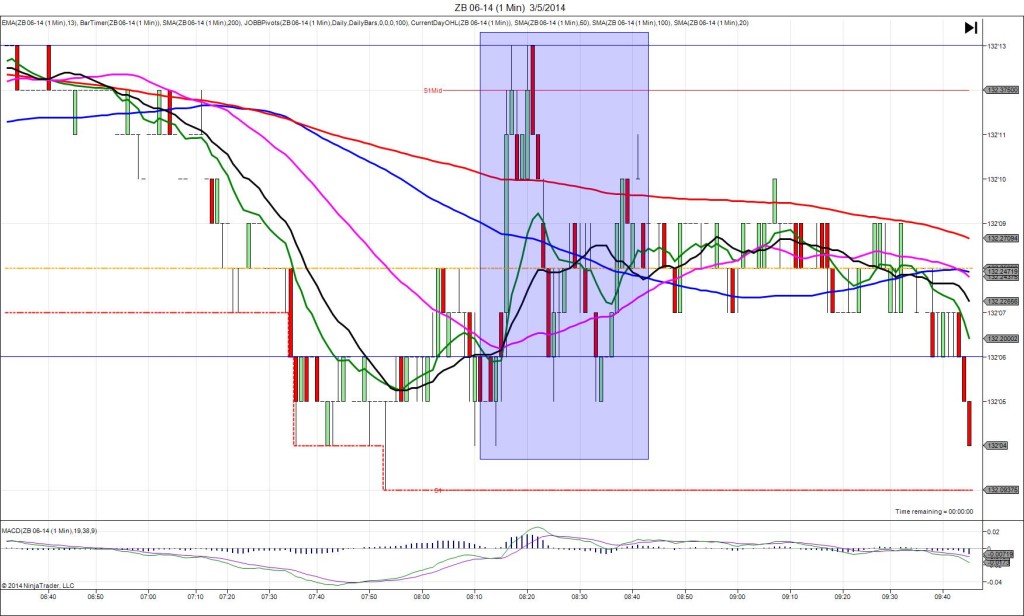

7/2/2014 ADP Non-Farm Employment Change (0815 EDT)

Forecast: 207K

Actual: 281K

Previous revision: n/a

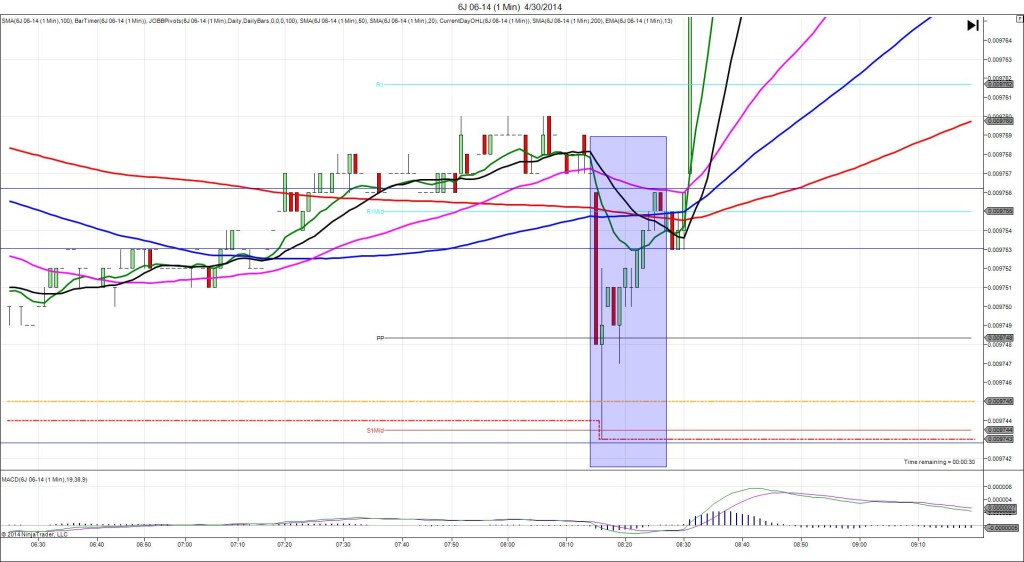

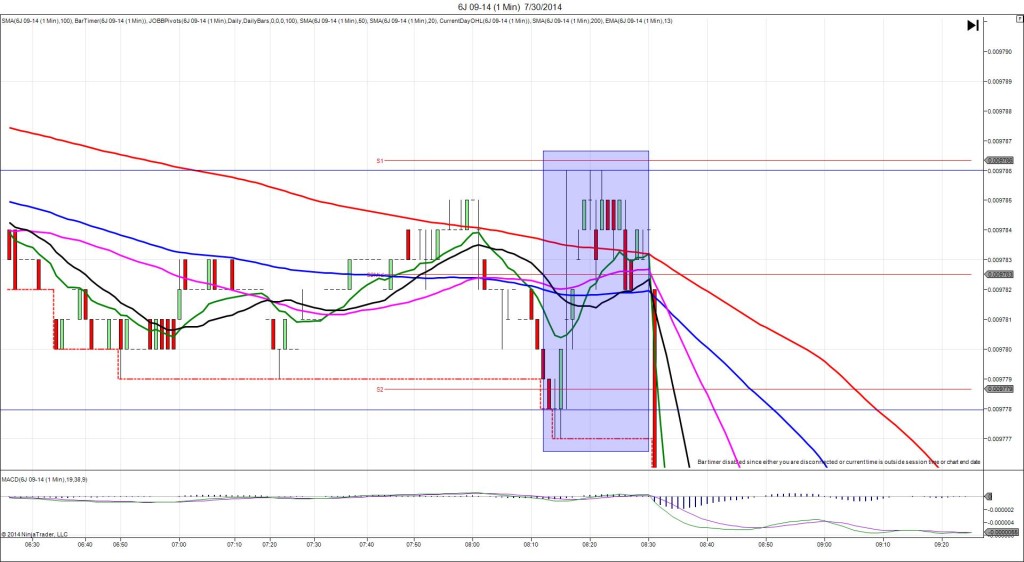

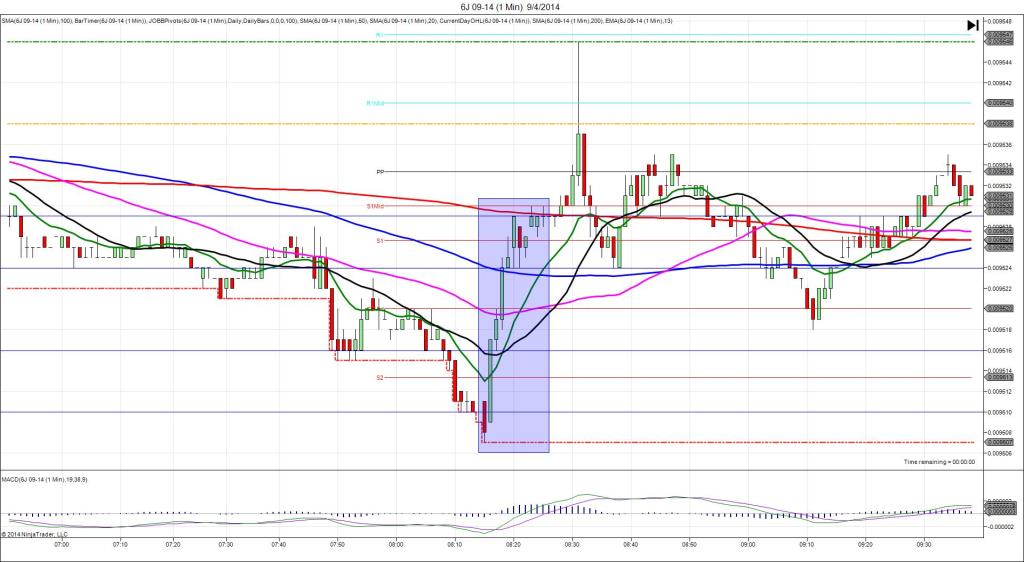

TRAP TRADE

Anchor Point @ 0.0009856 (last price)

————

Trap Trade:

)))1st Peak @ 0.009833 – 0815:00 (1 min)

)))-23 ticks

)))Reversal to 0.009844 – 0815:26 (1 min)

)))11 ticks

————

Continued reversal to 0.009849 – 0818 (3 min)

16 ticks

Double Bottom to 0.009833 – 0846 (16 min)

16 ticks

Trap Trade Bracket setup:

Long entries – 0.009846 (on the OOD) / 0.009837 (just below the S3 Mid Pivot)

Short entries – 0.009866 (on the HOD) / 0.009876 (just below the R3 Mid Pivot)

Notes: Report came in strongly better than the forecast by 74k jobs causing a quick short spike of 23 ticks that crossed the OOD, S3 Mid Pivot, and extended the LOD. Then it retreated 11 ticks in only 26 sec to the S2 Pivot. That would have filled the inner and outer tier long orders with about 4 ticks excess making your average entry about 0.009841. Look to exit where it hovered at about 9844 for about 6 total ticks on 2 fills. It continued to reverse for 5 more ticks early on the 3rd bar, but due to the biased report, waiting for more ticks would not be wise in this case. This proved correct as it fell for a double bottom 13 min later then remained near the LOD for over an hour until it dropped again.