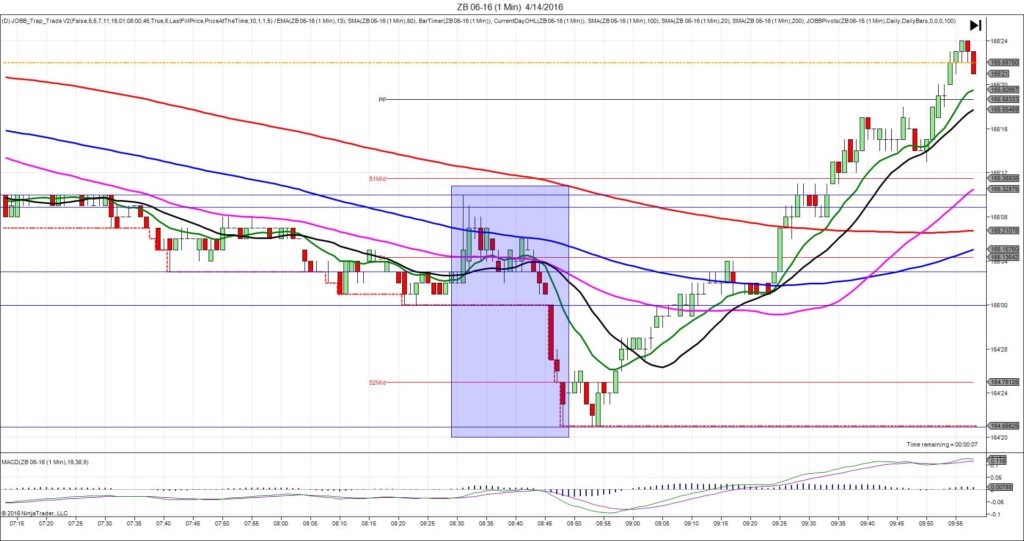

6/10/2016 World Agriculture Supply and Demand Estimates (WASDE) – Corn (1200 EDT)

Forecast: n/a

Actual: n/a

SPIKE / REVERSE

Started @ 427.25

1st Peak @ 437.00 – 1200:28 (1 min)

39 ticks

Reversal to 430.50 – 1200:37 (1 min)

26 ticks

Pullback to 433.75 – 1203 (3 min)

13 ticks

Reversal to 424.25 – 1207 (7 min)

38 ticks

Pullback to 431.25 – 1209 (9 min)

28 ticks

Reversal to 420.00 – 1223 (23 min)

45 ticks

Expected Fill: 430.00 (long)

Slippage: 6 ticks

Best Initial Exit: 436.75 – 27 ticks

Recommended Profit Target placement: 435.00 (just above the R3 Pivot), 436.75 (just above the R4 Mid Pivot), 438.75 (just above the R4 Pivot)

Notes: Beautiful long spike that was stepped up and hovered before reversing strongly after 30 sec. Be sure to take precautions upon the hovering below the R4 Mid Pivot.