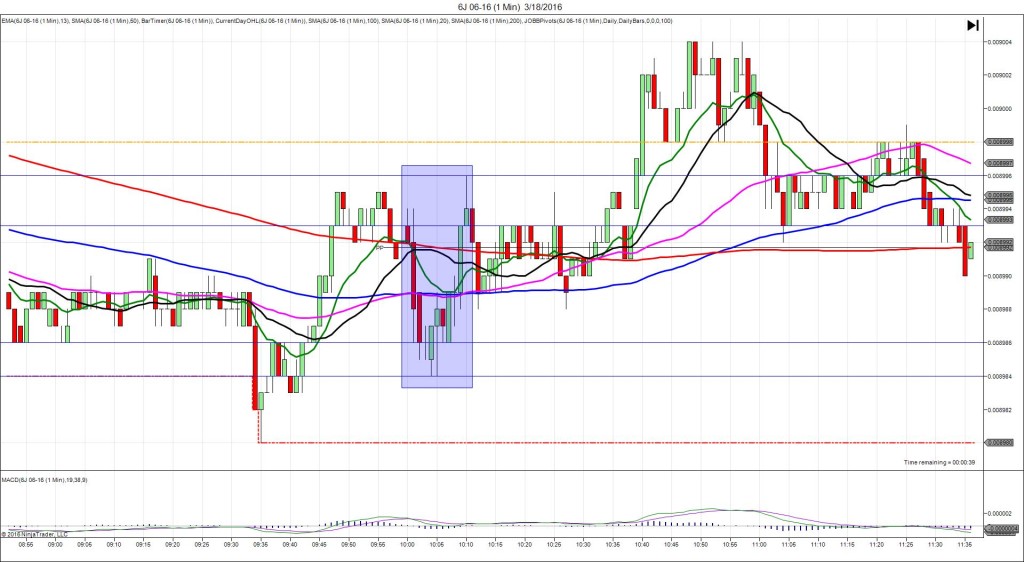

4/15/2016 Prelim UoM Consumer Sentiment (1000 EDT)

Forecast: 91.9

Actual: 89.7

Previous Revision: +1.0 to 91.0

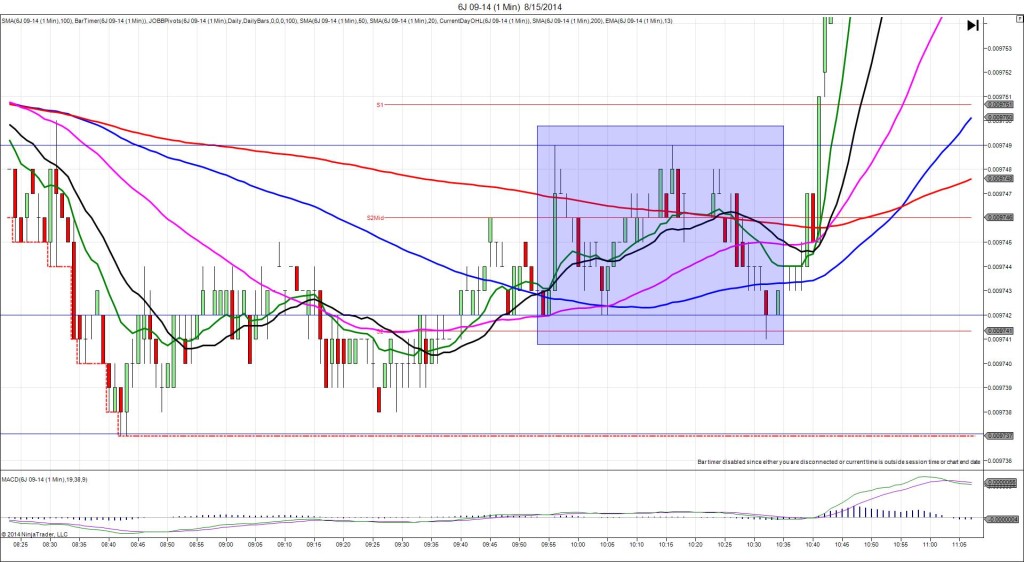

TRAP TRADE – OUTER TIER DULL FILL

Anchor Point @ 0.0091910

————

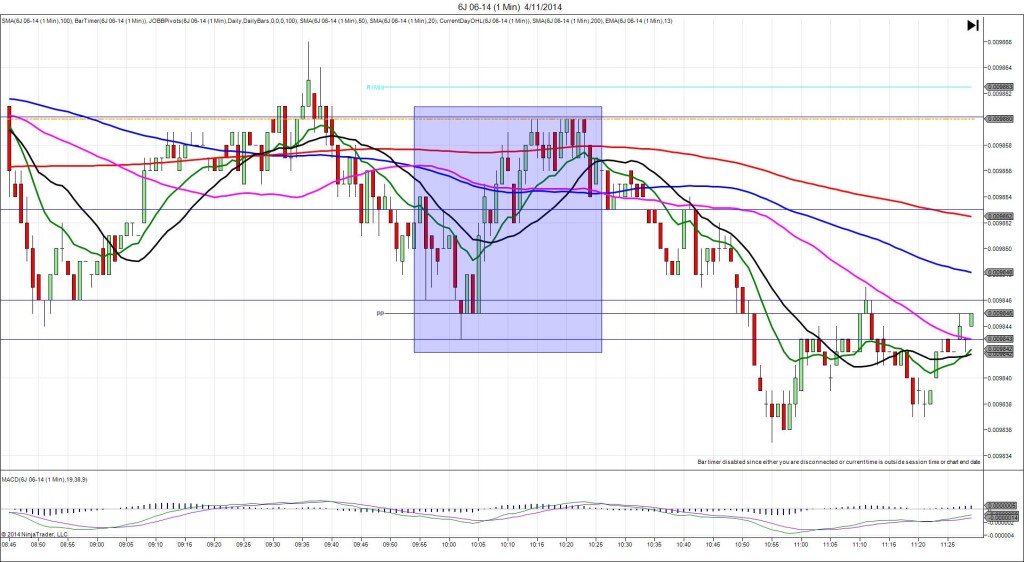

Trap Trade:

)))1st Peak @ 0.0091990 – 1000:12 (1 min)

)))16 ticks

)))Reversal to 0.0091950 – 1000:39 (1 min)

)))-8 ticks

)))Pullback to 0.0092015 – 1000:55 (1 min)

)))13 ticks

————

Reversal to 0.0091975 – 1003 (3 min)

8 ticks

Final Peak @ 0.0092210 – 1021 (21 min)

60 ticks

Reversal to 0.0092060 – 1037 (10 min)

12 ticks

Trap Trade Bracket setup:

Long entries – 0.0091880 (No Pivot / SMA near) / 0.0091830 (just above the R1 Mid Pivot)

Short entries – 0.0091945 (just above the 200 SMA) / 0.0091985 (No SMA / Pivot near)

Expected Fill: n/a – 0.0091945 and 0.0091985 – both short tiers

Best Initial Exit: 0.0091950 – 6 total ticks

Recommended Profit Target placement: 0.0091950 (just above the 200 SMA) and 0.0091920 (just below the R1 Pivot)

Notes: Both short tiers would have filled in a staggered manner as it stepped higher in 12 sec. Then you would have had a 10 sec window to exit with 2-6 total ticks after 30 sec. If you did not exit there, it would have gone against you then come back to hover about 4-6 ticks in the red. Then it claimed a 2nd peak after 20 min to the R2 Pivot followed by a reversal to the 50 SMA.