4/20/2016 Weekly Crude Oil Inventory Report (1030 EDT)

Forecast: 2.40M

Actual: 2.08M

Gasoline

Forecast: -1.22M

Actual: -0.11M

Distillates

Forecast: 0.30M

Actual: -3.55M

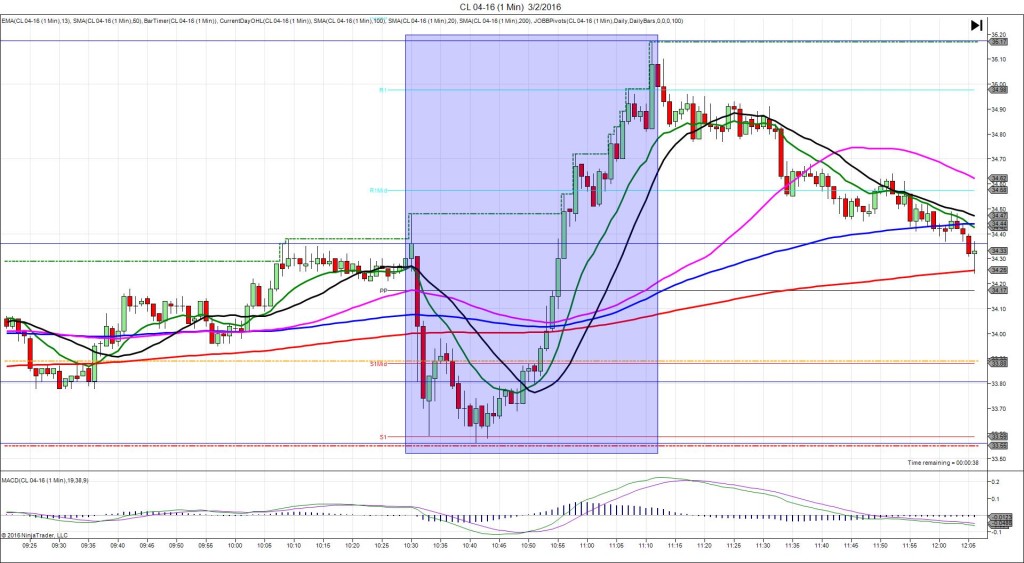

SPIKE WITH 2ND PEAK

Started @ 41.55

1st Peak @ 41.88 – 1030:34 (1 min)

33 ticks

Reversal to 41.67 – 1030:59 (1 min)

21 ticks

2nd Peak @ 42.17 – 1033 (3 min)

62 ticks

Reversal to 41.82 – 1039 (9 min)

35 ticks

Final Peak @ 44.07 – 1308 (158 min)

252 ticks

Expected Fill: 41.65 (long)

Slippage: 0 ticks

Best Initial Exit: 41.87 – 22 ticks

Recommended Profit Target placement: 41.90 (35 ticks) and 42.16 (just above the PP Pivot)

Notes: Big draw on heating oil while the crude and gas figures were narrowly offsetting. This caused a racheting long move for 33 ticks then another 29 ticks in the next 2 min. A no slippage fill offered up to 22 ticks early, or about 50 with patience. It settled into a huge long trend after conquering the PP Pivot that continued for 2.5 hrs.