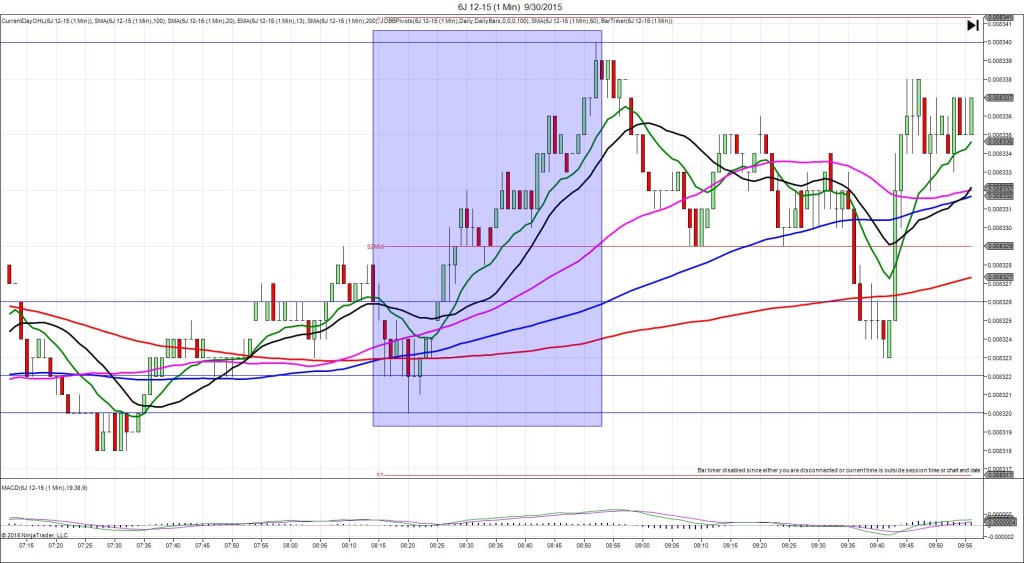

9/2/2015 ADP Non-Farm Employment Change (0815 EDT)

Forecast: 204K

Actual: 190K

Previous revision: -8K to 177K

TRAP TRADE – INNER TIER

Anchor Point @ 0.008325 (last price)

————

Trap Trade:

)))1st Peak @ 0.008336 – 0815:00 (1 min)

)))11 ticks

)))Reversal to 0.008325 – 0815:07 (1 min)

)))-11 ticks

)))Pullback to 0.008334 – 0815:34 (1 min)

)))9 ticks

————

Reversal to 0.008323 – 0821 (6 min)

11 ticks

Pullback to 0.008332 – 0822 (7 min)

9 ticks

Reversal to 0.008311 – 0904 (34 min)

21 ticks

Trap Trade Bracket setup:

Long entries – 0.008315 (just below the S2 Mid Pivot) / 0.008305 (just above the S2 Pivot)

Short entries – 0.008335 (on the S1 Mid Pivot / 200 SMA) / 0.008344 (just above the PP Pivot)

Expected Fill: 0.008335 (inner short tier)

Best Initial Exit: 0.008326 – 9 ticks

Recommended Profit Target placement: 0.008327 (just above the S1 Pivot)

Notes: Nice inner tier entry that allowed up to 9 ticks to be captured on the first hovering. Good reversal opportunity at 0824 after 3 bars could not go any higher with the 200 SMA looming above.