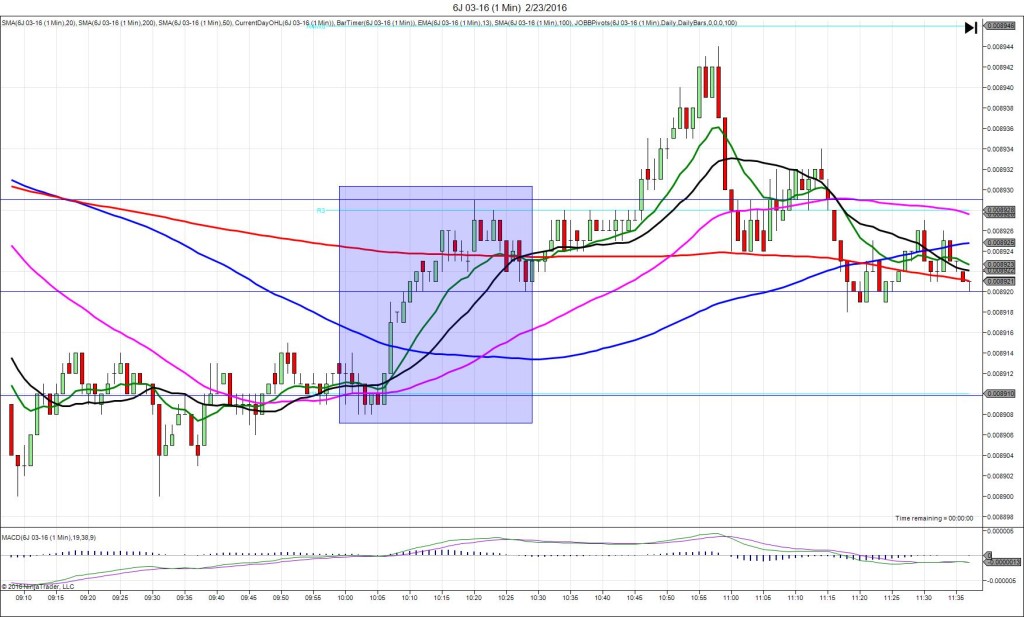

3/29/2016 Monthly CB Consumer Confidence (1000 EDT)

Forecast: 93.9

Actual: 96.2

Previous revision: +1.8 to 94.0

DULL NO FILL

Started @ 0.008836

1st Peak @ 0.008833 – 1000:29 (1 min)

3 ticks

Reversal to 0.008838 – 1003 (3 min)

5 ticks

Expected Fill: n/a – cancel

Slippage: n/a

Best Initial Exit: n/a

Recommended Profit Target placement: n/a

Notes: Dull reaction but no move from the origin of 2 ticks or more until about 30 sec after the release. This would have been an easy decision to cancel the trade. After that it continued to remain between the S1 and S1 Mid Pivot for 25 min showing no impulse from the news.