3/31/2015 Monthly CB Consumer Confidence (1000 EDT)

Forecast: 96.6

Actual: 101.3

Previous revision: +2.4 to 98.8

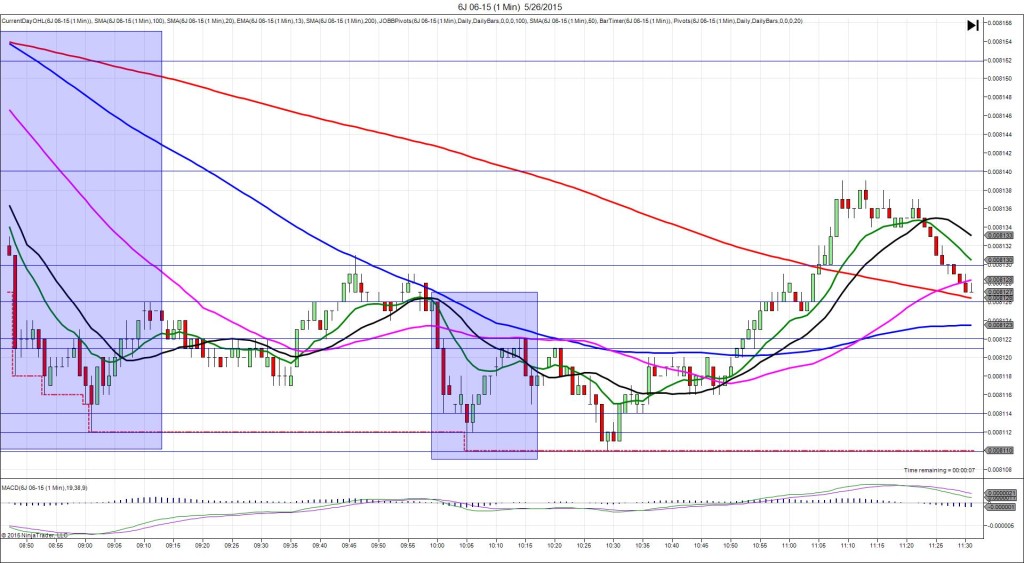

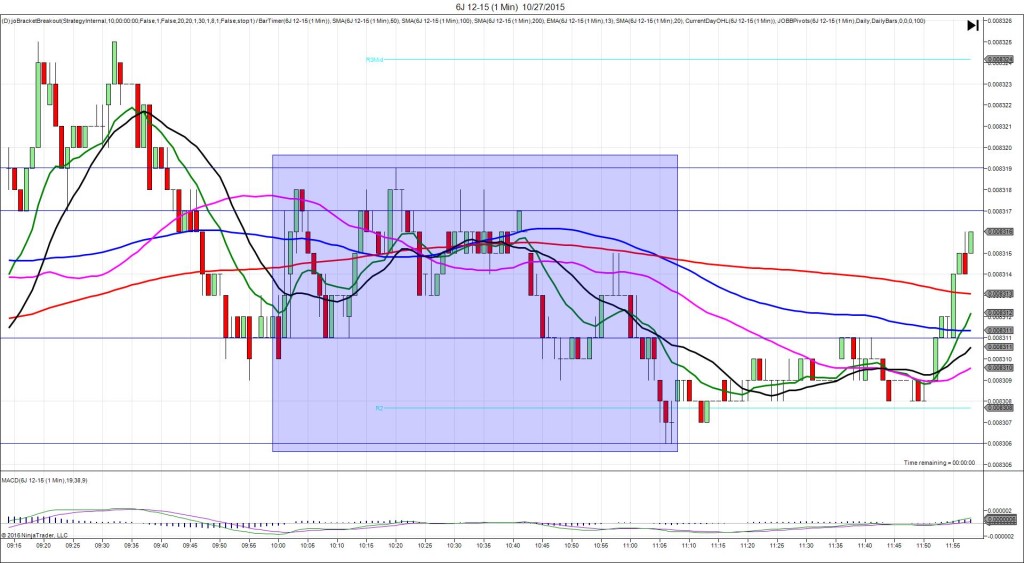

SPIKE WITH 2ND PEAK

Started @ 0.008342

1st Peak @ 0.008336 – 1000:02 (1 min)

6 ticks

Reversal to 0.008343 – 1000:37 (1 min)

7 ticks

2nd peak @ 0.008331 – 1010 (10 min)

11 ticks

Reversal to 0.008358 – 1046 (46 min)

27 ticks

Pullback to 0.008339 – 1101 (61 min)

19 ticks

Notes: Report exceeded the forecast by a healthy margin of 4.7 pts coupled with a large upward revision to the previous reading. This caused a small short move of only 6 ticks that was shortly sustained. It started just above the R1 Mid Pivot and fell to reach the OOD / PP Pivot. With JOBB, your short order would have filled at 0.008339 with no slippage then allowed an exit with 1-2 ticks as it hovered. Then it reversed 7 ticks later in the bar before falling for a 2nd peak of 5 more ticks in 9 min after crossing the PP Pivot. Then it reversed 27 ticks in 36 min to cross the R2 Mid Pivot and extend the HOD before pulling back 19 ticks in 15 min to the R1 Mid Pivot.