2/26/2013 Monthly CB Consumer Confidence (1000 EST)

Forecast: 60.8

Actual: 69.6

Previous revision: -0.2 to 58.4

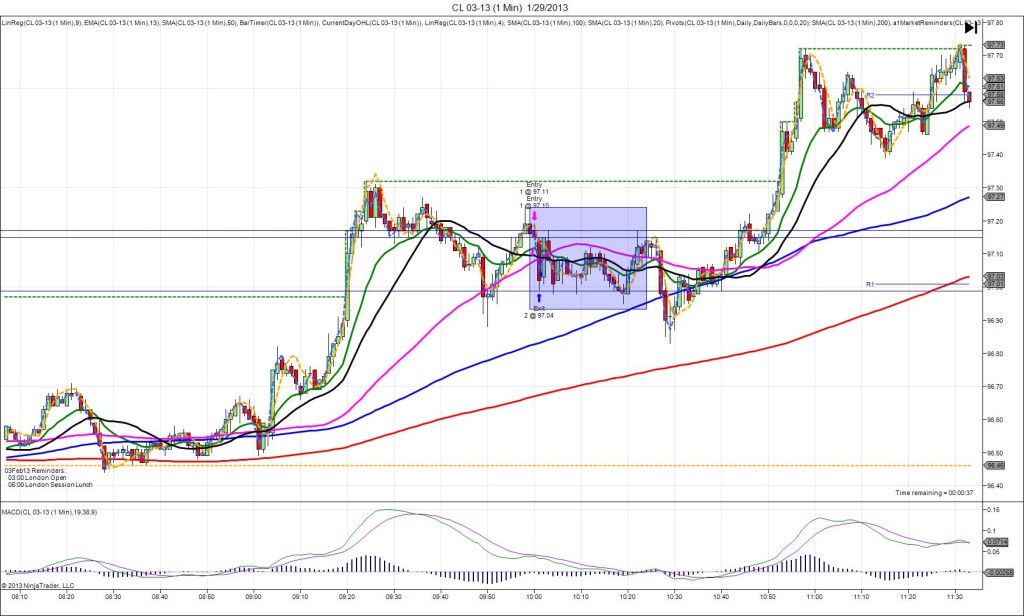

SPIKE/REVERSE SPIKE/REVERSE

Started @ 93.11

1st Peak @ 93.44 – 1003 (3 min)

33 ticks

Reversal to 92.52 – 1036 (36 min)

92 ticks

Notes: Report strongly exceeded the forecast by a decent margin and caused a long reaction of 33 ticks culminating on the :03 bar that crossed the PP Pivot and extended the HOD by 23 ticks. With JOBB you would have filled long at 93.17 with 1 tick of slippage. Watch how it interacts with the PP Pivot and consider the strong report when evaluating the exit. with the :02 bar breaking easily, stay in and look to close out around 93.37 or so for about 20 ticks. This report broke at the same time as the FED testimony, but being statistical, the impact was felt more immediately. The reversal was mostly caused by the dollar rallying on the FED testimony aided by the reversal on this report. This resulted in a 92 tick drop in about 30 min down to the S1 Pivot.

-112712.jpg)

-110112.jpg)

-092512.jpg)

-082812.jpg)

-073112.jpg)

-062612.jpg)

-052912.jpg)

-032712.jpg)