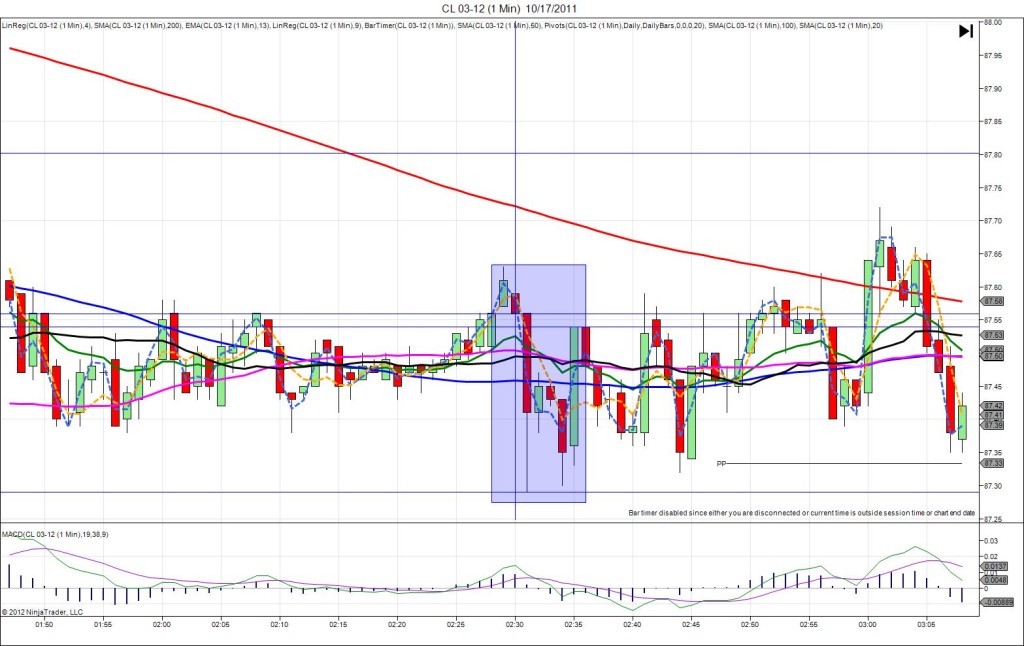

6/17/2013 Monthly Empire State Manufacturing Index (0830 EDT)

Forecast: 0.4

Actual: 7.8

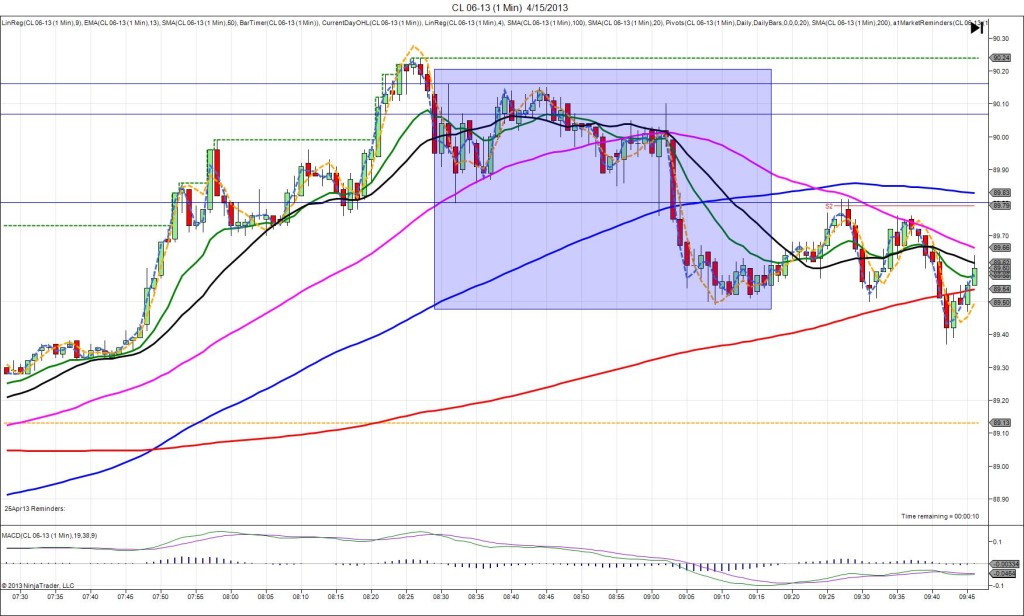

DULL REACTION

Started @ 98.26

1st Peak @ 98.32 – 0831 (1 min)

6 ticks

Reversal to 97.91 – 0846 (16 min)

41 ticks

Notes: Report moderately exceeded the forecast and barely impressed the market. It was also caught in the middle of a small correction after a large short move in the previous hour. The correction had exhausted the bulls as it ran into the 50 SMA and the R1 Pivot and then it was looking for another short move. The moderately bullish news was not enough to sustain the long move. We saw an initial long move of 6 ticks, then it stalled and hovered before slowly falling. With JOBB, you would have filled long at 98.30 with no slippage, then look to exit near breakeven as it only gave you about 1-2 ticks of profit opportunity. After the :31 and :32 bars hovered above the 50 SMA, it fell for a reversal of 41 ticks in the next 15 min.