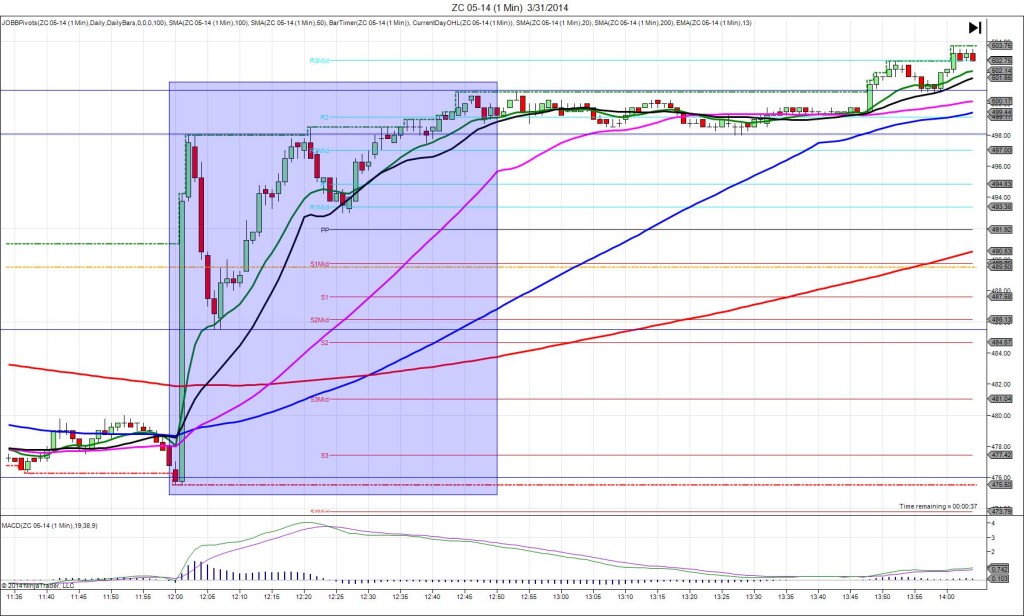

3/31/2016 Grain Stocks – Corn (1200 EDT)

Forecast: n/a

Actual: n/a

SPIKE / REVERSE

Started @ 362.00

1st Peak @ 353.50 – 1200:59 (1 min)

34 ticks

Reversal to 360.75 – 1204 (4 min)

29 ticks

Pullback to 353.00 – 1213 (13 min)

31 ticks

Reversal to 355.75 – 1219 (19 min)

11 ticks

Final Peak @ 347.75 – 1327 (87 min)

57 ticks

Expected Fill: 360.50 (short)

Slippage: 0 ticks

Best Initial Exit: 353.75 – 27 ticks

Recommended Profit Target placement: 354.25 (just below the S3 Pivot)

Notes: Tame short spike offered a no slippage fill and an exit with up to 27 ticks as the :01 bar expired just below the S3 Pivot. Then a nice reversal in 3 min to the 13/20 SMAs followed by a double bottom. After that it trickled lower in about 1.5 hrs to the S4 Pivot.