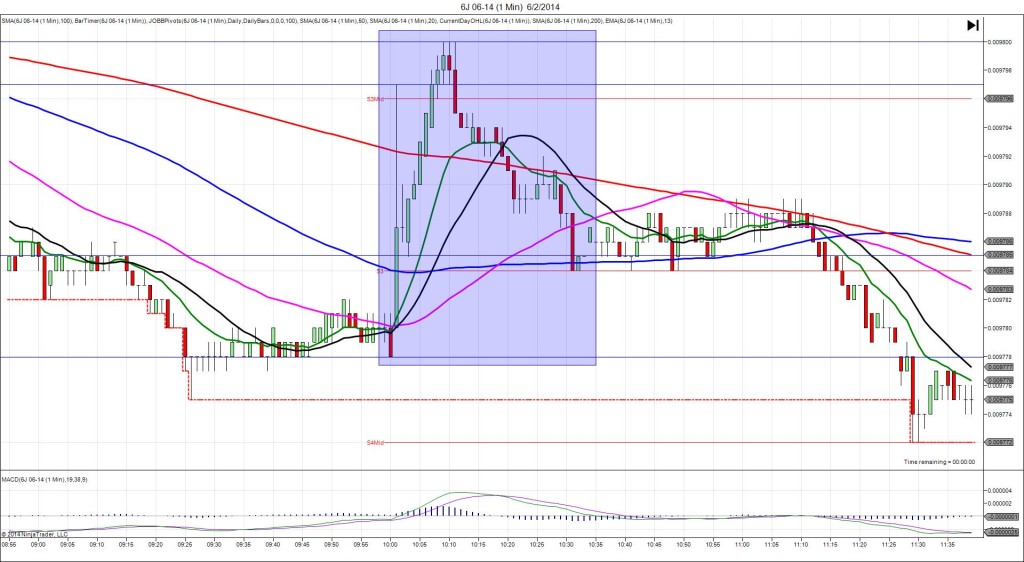

4/1/2016 Monthly ISM Manufacturing PMI (1000 EDT)

Forecast: 50.8

Actual: 51.8

Previous revision: n/a

SPIKE WITH 2ND PEAK

Started @ 0.008942

1st Peak @ 0.008929 – 1001:09 (2 min)

13 ticks

Reversal to 0.008935 – 1004 (4 min)

6 ticks

2nd Peak @ 0.008910 – 1014 (14 min)

32 ticks

Reversal to 0.008921 – 1032 (32 min)

11 ticks

Expected Fill: 0.008938 (short)

Slippage: 1 tick

Best Initial Exit: 0.008930 – 8 ticks

Recommended Profit Target placement: 0.008927 (just below the R1 Pivot) – move higher

Notes: Nice stable spike fell for 13 ticks in a little over 1 min. This would have seen a low slippage short fill then allowed up to 8 ticks to be captured as it slowly settled. Then a small reversal to the 13 SMA followed by a 2nd peak of 19 more ticks to the PP Pivot.