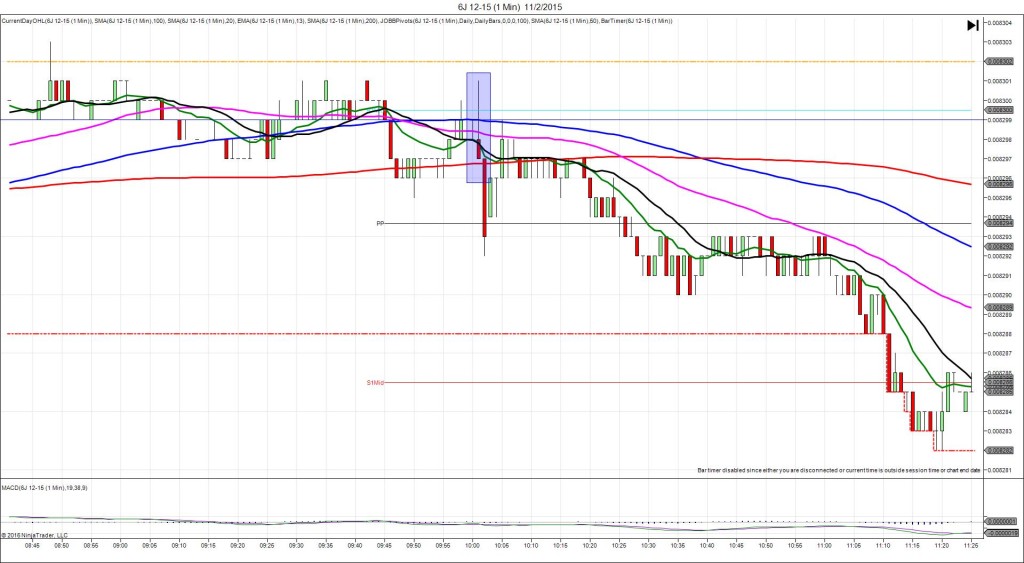

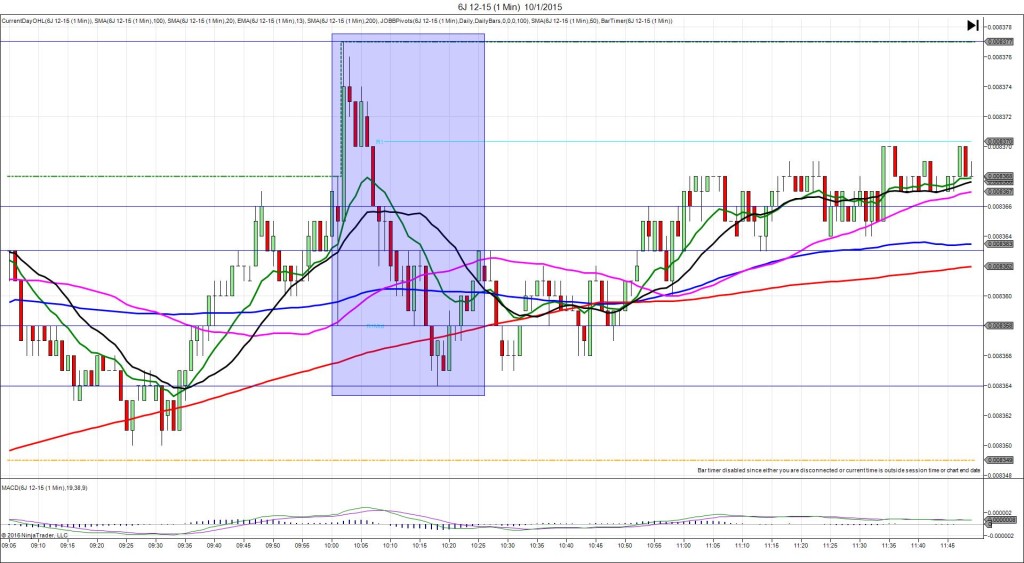

10/1/2015 Monthly ISM Manufacturing PMI (1000 EDT)

Forecast: 50.8

Actual: 50.2

Previous revision: n/a

SPIKE / REVERSE

Started @ 0.008367

1st Peak @ 0.008358 – 1000:22 (1 min)

9 ticks

Reversal to 0.008377 – 1001:47 (2 min)

19 ticks

2nd Peak @ 0.008354 – 1018 (18 min)

13 ticks

Reversal to 0.008363 – 1025 (25 min)

9 ticks

Expected Fill: 0.008364 (short)

Slippage: 0 ticks

Best Initial Exit: 0.008359 – 5 ticks

Recommended Profit Target placement: 0.008355 (just below the 200 SMA) – move up slightly

Notes: Small spike due to minimal offset and strong support at the 50 / 100 SMAs and R1 Mid Pivot. Look for the first sign of hovering or retreat at a level of support and exit quickly. Good 2nd peak opportunity due to sharp reversal after the 1st peak.