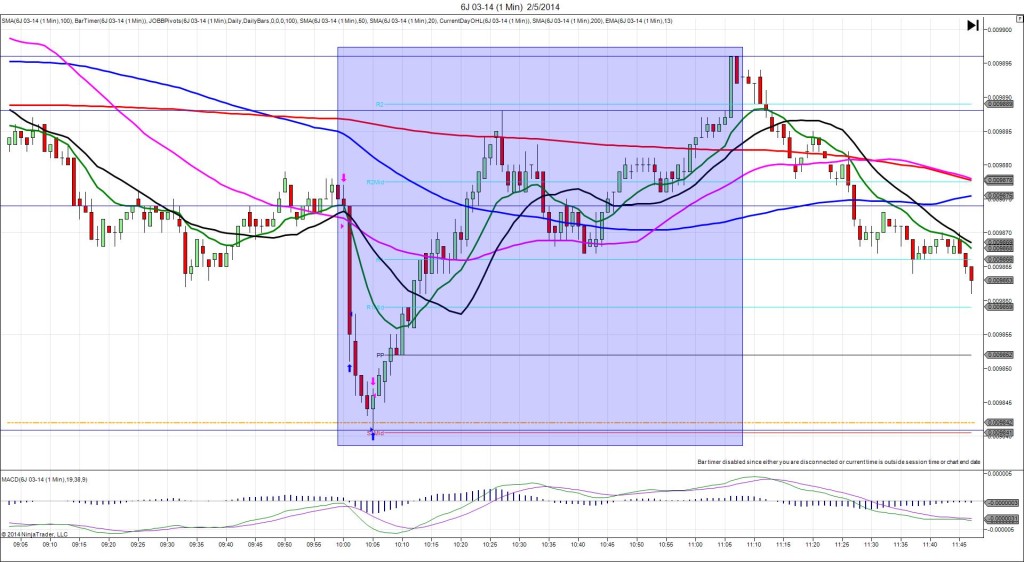

2/5/2014 Monthly ISM Non-Manufacturing PMI (1000 EST)

Forecast: 53.6

Actual: 54.0

Previous Revision: n/a

SPIKE WITH 2ND PEAK

Started @ 0.009874

1st Peak @ 0.009851 – 1001 (1 min)

23 ticks

Reversal to 0.009858 – 1002 (2 min)

7 ticks

2nd Peak @ 0.009841 – 1005 (5 min)

33 ticks

Reversal to 0.009888 – 1027 (27 min)

47 ticks

Extended Reversal to 0.009896 – 1106 (66 min)

55 ticks

Notes: Mildly positive report exceeded the forecast by 0.4 points. This caused a short spike of 23 ticks on the :01 bar as it started just above the 50 SMA, then fell to hit the PP Pivot. With JOBB, you would have filled short at about 0.009871 with no slippage, then seen it fall and ratchet lower to eventually hit the PP Pivot. If you were patient, you could have captured up to 19 ticks. I managed 13 ticks with a profit target just below the R1 Mid Pivot. After the 1st peak, it reversed for 7 ticks back to the R1 Mid Pivot before falling for a 2nd peak of 10 more ticks on the :05 bar near the OOD and S1 Mid Pivot. Then it reversed for 47 ticks in the next 22 min back to the 200 SMA. It backed off more than 20 ticks, before it continued to climb for another high, 8 ticks higher after 1100.