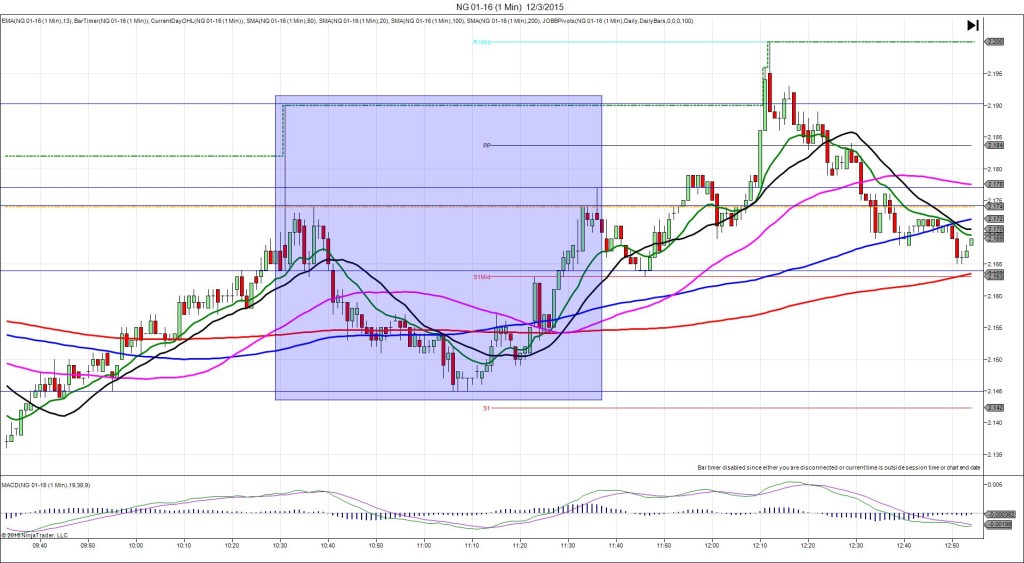

11/13/2015 Weekly Natural Gas Storage Report (1030 EST)

Forecast: 51B

Actual: 49B

DULL FILL

Started @ 2.323

1st Peak @ 2.333 – 1030:04 (1 min)

10 ticks

Reversal to 2.300 – 1030:24 (1 min)

33 ticks

Pullback to 2.330 – 1036 (6 min)

30 ticks

Reversal to 2.320 – 1041 (11 min)

10 ticks

2nd Peak @ 2.375 – 1121 (51 min)

52 ticks

Reversal to 2.328 – 1212 (102 min)

53 ticks

Expected Fill: 2.333 (long)

Slippage: 0 ticks

Best Initial Exit: 2.333 – Breakeven (likely exit 2.326 to 2.329 – 4-7 tick loss)

Recommended Profit Target placement: 2.360 (just above the R2 Pivot) – move lower

Notes: Dull reaction barely filled then hovered and recoiled. In this scenario look to exit quickly as it is unusual and likely to continue to reverse. The results were nearly matching too. After the sharp reversal, it rebounded and eventually turned into a long trend.