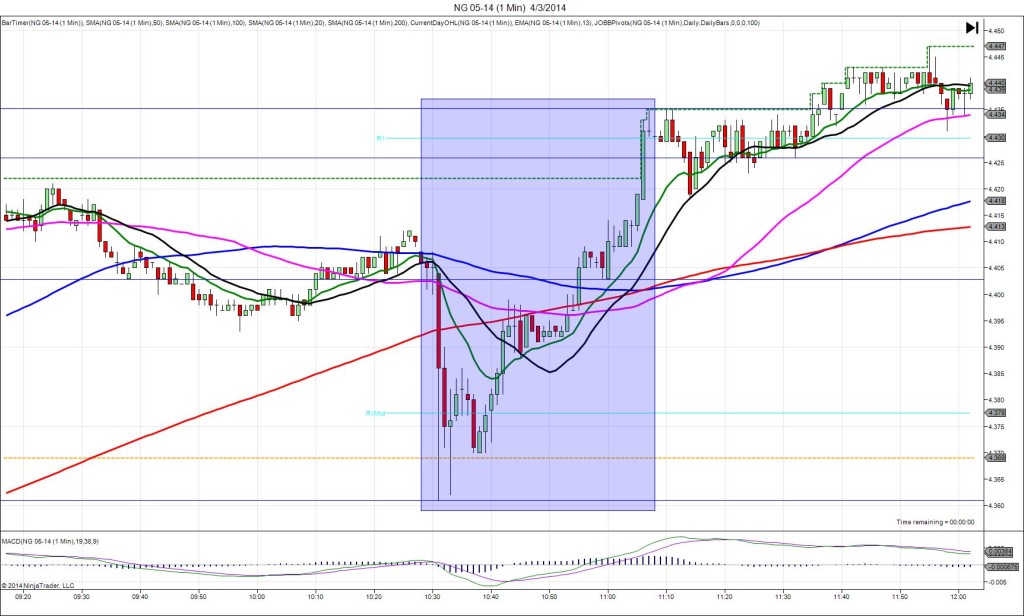

3/20/2014 Weekly Natural Gas Storage Report (1030 EDT)

Forecast: -58B

Actual: -48B

SPIKE / REVERSE

Started @ 4.434 (1029)

1st Peak @ 4.356 – 1031 (1 min)

78 ticks

Reversal to 4.410 – 1038 (8 min)

54 ticks

Pullback to 4.371 – 1100 (30 min)

39 ticks

Reversal to 4.393 – 1105 (35 min)

22 ticks

Notes: Smaller draw on the reserve compared to the forecast saw a large short spike with the action on the :30 bar easily contained within the bracket. The spike crossed all 3 major SMAs and the S2 Pivot then touched the LOD for 78 ticks on the :31 bar. It retreated late in the bar leaving 20 ticks on the tail naked. With JOBB, you would have filled short at about 4.401 with 23 ticks of slippage on the :31 bar, then seen it continue to ratchet lower and hit the LOD after 7 sec. Look to exit at about 4.365 with about 35 ticks where it hovered for about 7 sec. After the peak, it reversed for 54 ticks in the next 7 min back to the S2 Mid Pivot and 200 SMA. Then it pulled back for 39 ticks in 22 min before a quick reversal of 22 ticks around the S2 Pivot.