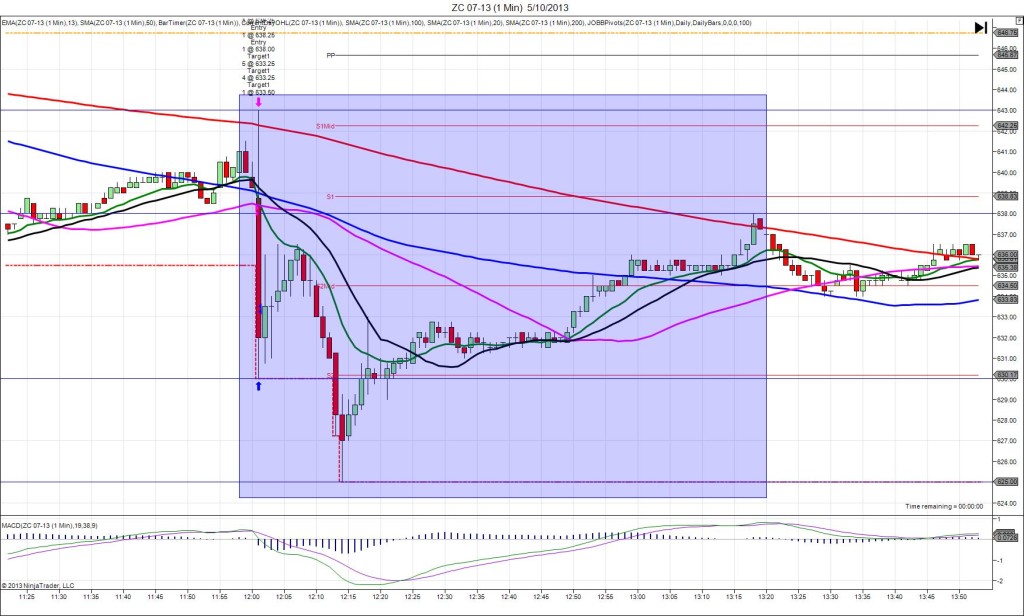

1/11/2013 Grain Stocks – Corn (1200 EST)

Forecast: n/a

Actual: n/a

SPIKE WITH 2ND PEAK

Started @ 687.00

1st Peak @ 717.00 – 0703 (1 min)

120 ticks

Reversal to 701.50 – 0714 (14 min)

62 ticks

2nd Peak @ 723.75 – 0756 (56 min)

147 ticks

Reversal to 712.75 – 0848 (108 min)

44 ticks

Notes: Report time shifted to 1200 Eastern for this and all future reports. Report Reaction caused a long spike of 120 ticks over 3 bars that completely changed the sentiment of the market as it had been selling off below the S3 Pivot and was at the LOD. The report drove it North through every measurable level of resistance to peak over 40 ticks above the R3 Pivot. After the first peak, it retreated to the R2 Pivot and 20 SMA in about 10 min, then engineered a long developing 2nd peak for another 27 ticks above the 1st peak nearly an hour after the report. I would be cautious trading later moves as you are in the afternoon session of Friday, but this was a very solid report. The final reversal after the 2nd peak yielded 44 ticks in about 50 min.