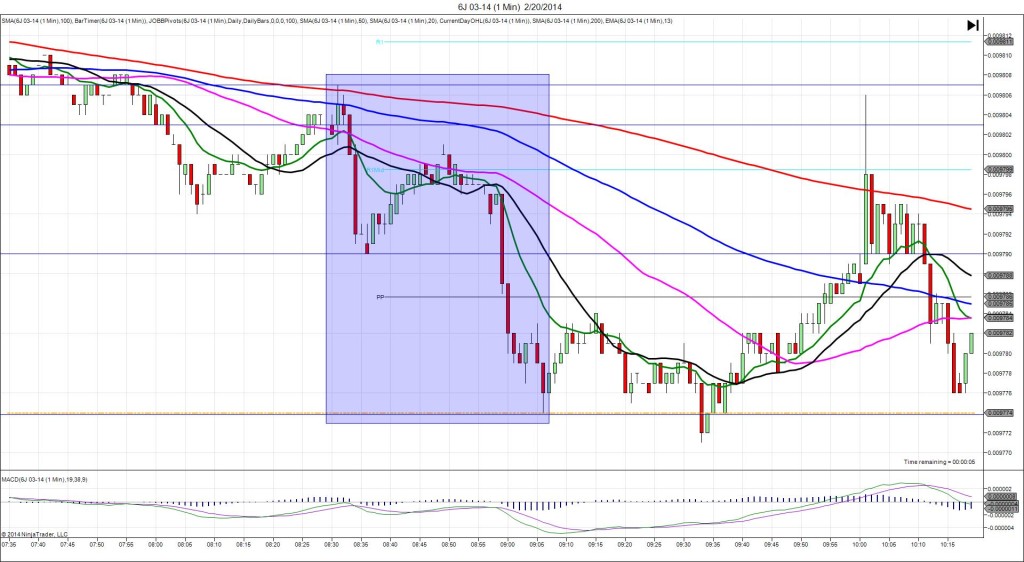

2/13/2014 Weekly Unemployment Claims (0830 EST)

Forecast: 331K

Actual: 339K

TRAP TRADE (SPIKE WITH 2ND PEAK)

Anchor Point @ 0.009817 (last price and on the R3 Mid Pivot)

————

Trap Trade:

Dull Reaction with only 12 ticks span of movement on the :31 bar

————

Trap Trade Bracket setup:

Long entries – 0.009807 (below the 200 SMA) / 0.009798 (just below the R2 Pivot)

Short entries – 0.009828 (no SMA/Pivot near) / 0.009836 (just above the R3 Pivot)

Notes: Report was double booked with retail sales, so we used a slightly larger 1st tier of 10-12 ticks. Surprising, all readings were bearish, but the 6J failed to launch until the :32 bar with only 7 tick movement from the anchor point. With no impulse to fill either side of the Trap bracket, cancel the order after 20 sec. The reaction came late for no apparent reason, but resulted in a 23 tick upward spike on the :32 bar, nearly reaching the R3 Pivot. Then it reversed for 23 ticks in the next 30 min back to the 100 SMA. Then it rebounded long, but was only able to achieve 2 ticks less than the 1st peak, before falling again.