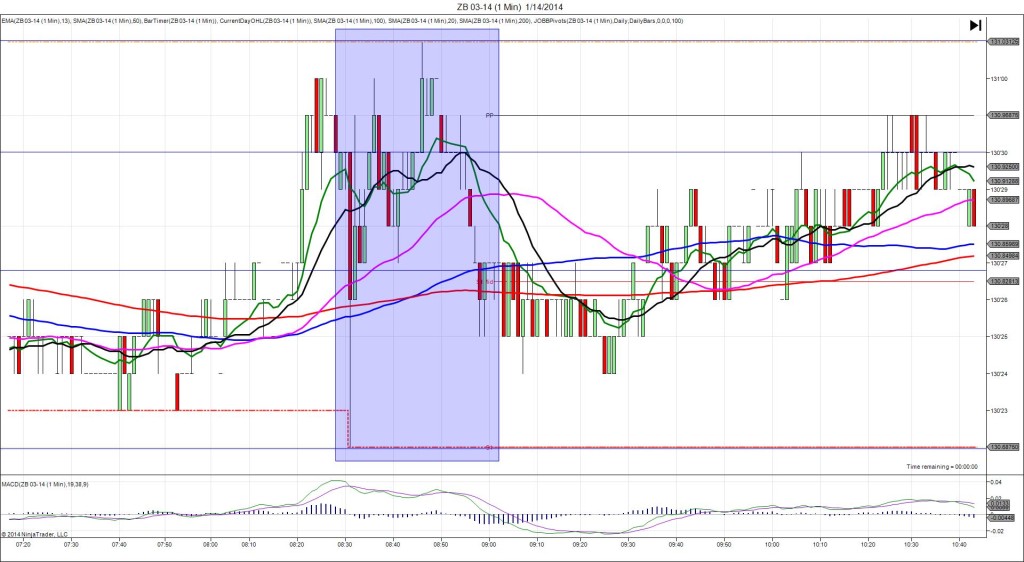

1/14/2014 Monthly Retail Sales (0830 EST)

Core Forecast: 0.4%

Core Actual: 0.7%

Previous revision: -0.3% to 0.1%

Regular Forecast: 0.2%

Regular Actual: 0.2%

Previous Revision: -0.3% to 0.4%

SPIKE / REVERSE

Started @ 130’30

1st Peak @ 130’22 – 0831 (1 min)

8 ticks

Reversal to 131’01 – 0846 (16 min)

11 ticks

Notes: Report was mixed overall, but the 0.3% positive offset on the core reading dominated the bearish revisions and matching regular reading. This caused a moderate short reaction of 8 ticks that crossed all 3 major SMAs and hit the LOD/S1 Pivot, then retreated leaving 4 ticks on the tail naked. With JOBB, you would have filled short at 130’26 with 2 ticks of slippage, then had an opportunity to capture 3-4 ticks on the S1 Pivot when it hovered for about 10 sec. After the retreat late in the :31 bar, it continued to reverse on the :32 bar to the PP Pivot for 9 ticks. Then it chopped between the PP Pivot and 50 SMA before gaining 2 more ticks on the :46 bar. After that it fell to get stuck on the 200 SMA and S1 Mid Pivot.