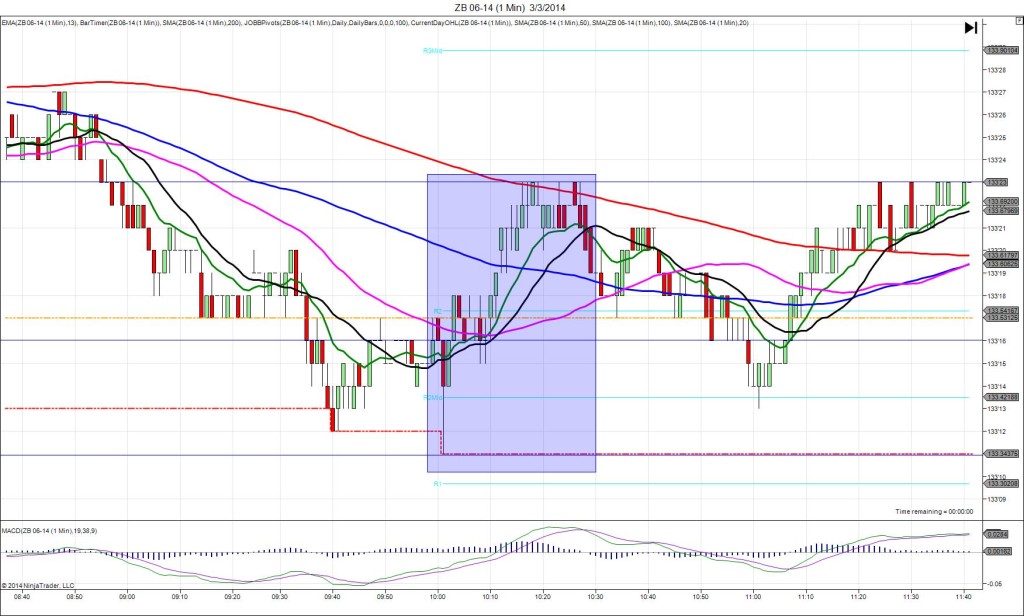

3/3/2014 Monthly ISM Manufacturing PMI (1000 EST)

Forecast: 52.3

Actual: 53.2

Previous revision: n/a

SPIKE / REVERSE

Started @ 133’16

1st Peak @ 133’11 – 1001 (1 min)

5 ticks

Reversal to 133’23 – 1016 (16 min)

12 ticks

Notes: Report came in modestly better than the forecast, with a reading 0.9 points above the forecast causing a small and shortly sustained bearish reaction. We saw a short spike of 5 ticks on the :01 bar that started just below the R2 Pivot / OOD / 50 SMA then crossed the R2 Mid Pivot and LOD for 5 ticks. With JOBB, you would have filled short at 133’13 with no slippage, then seen it settle to hover in between 133’13 and 133’12 for about 30 sec in the middle of the :01 bar allowing for an exit at breakeven or +1 tick. The quick pullback, lack of 2nd peak attempt and strong reversal were due to breaking news about Russian President Putin’s aggression in the Ukraine which caused a rally on the ZB and overrode the ISM sentiment. Normally we would have seen a stronger push lower for 2-4 more ticks, and/or a solid 2nd peak within 15 min. Instead we saw 12 tick reversal in 15 minutes to the 200 SMA. This is a case where you want to take the proactive step to get out with the hovering even if eating a 1-2 tick loss. Do not watch it slowly march to the 5 tick stop loss.