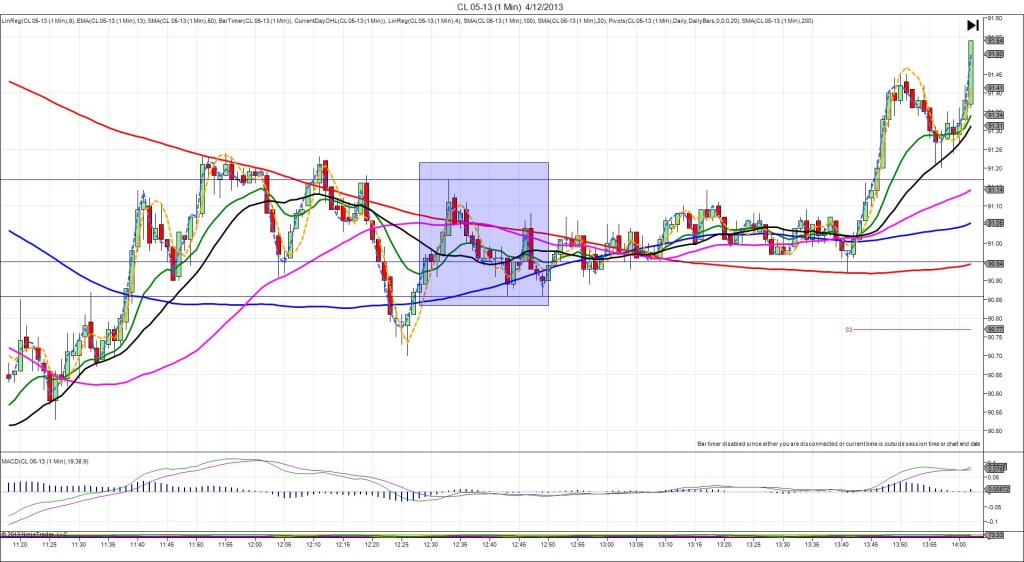

2/28/2013 Weekly Natural Gas Storage Report (1030 EST)

Forecast: -165B

Actual: -171B

INDECISIVE

Started @ 3.458

1st Peak @ 3.395 – 1031 (1 min)

63 ticks

Reversal to 3.460 – 1031 (1 min)

65 ticks

Extended Reversal to 3.492 (9 min)

97 ticks

Notes: Moderately greater loss than was forecast saw a short spike of 63 ticks that was unsustainable, followed by a quick reversal of 35 ticks. Then it hovered at the 3.430 area and continued long to 3.460 before the bar expired. With JOBB, you would have filled short at about 3.445, then had an opportunity to exit at about breakeven after the pullback. After the indecisive :31 bar, the reversal continued long for another 32 ticks in the next 8 min. Then it backed off and chopped sideways.