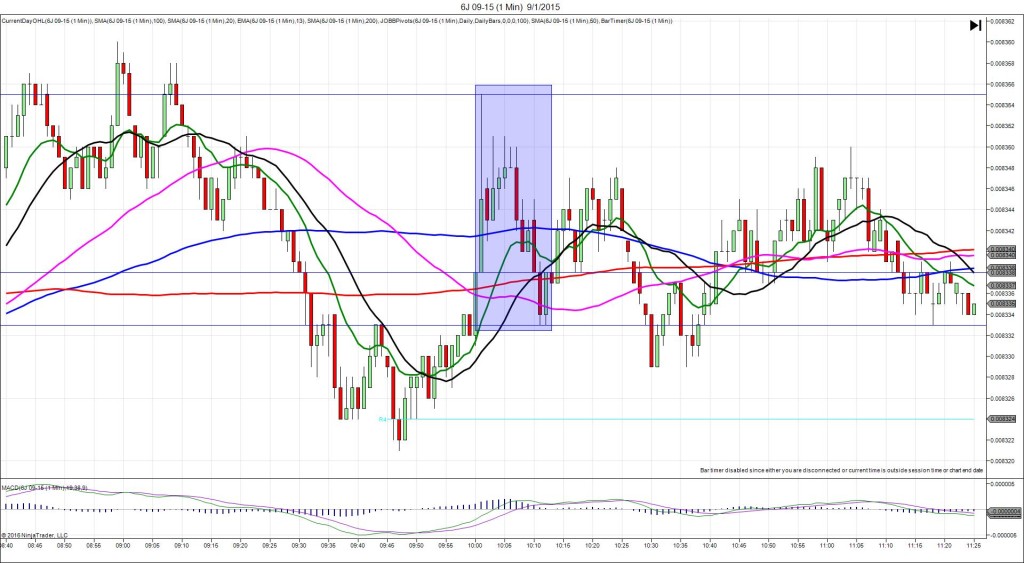

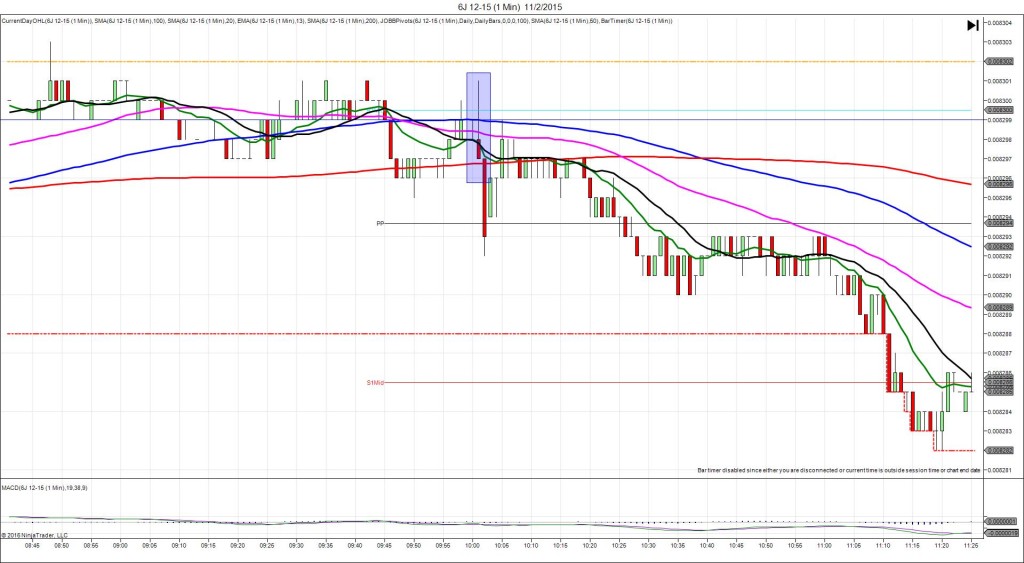

9/29/2015 Monthly CB Consumer Confidence (1000 EDT)

Forecast: 96.2

Actual: 103.0

Previous revision: -0.2 to 101.3

SPIKE WITH 2ND PEAK

Started @ 0.008356

1st Peak @ 0.008344 – 1000:21 (1 min)

12 ticks

Reversal to 0.008355 – 1005 (5 min)

11 ticks

Final Peak @ 0.008330 – 1029 (29 min)

26 ticks

Reversal to 0.008351 – 1049 (49 min)

21 ticks

Expected Fill: 0.008353 (short)

Slippage: 0 ticks

Best Initial Exit: 0.008345 – 8 ticks

Recommended Profit Target placement: 0.008346 (just below the PP Pivot)

Notes: Note how it used the 13 SMA as resistance for the 2nd peak. Several opportunities for short entries after the 1st peak reversal. Then the double bottom on the S1 Pivot was a signal for the reversal.