4/30/2014 Quarterly Advance GDP (0830 EDT)

Forecast: 1.2%

Actual: 0.1%

Previous Revision: -0.6% to 2.6%

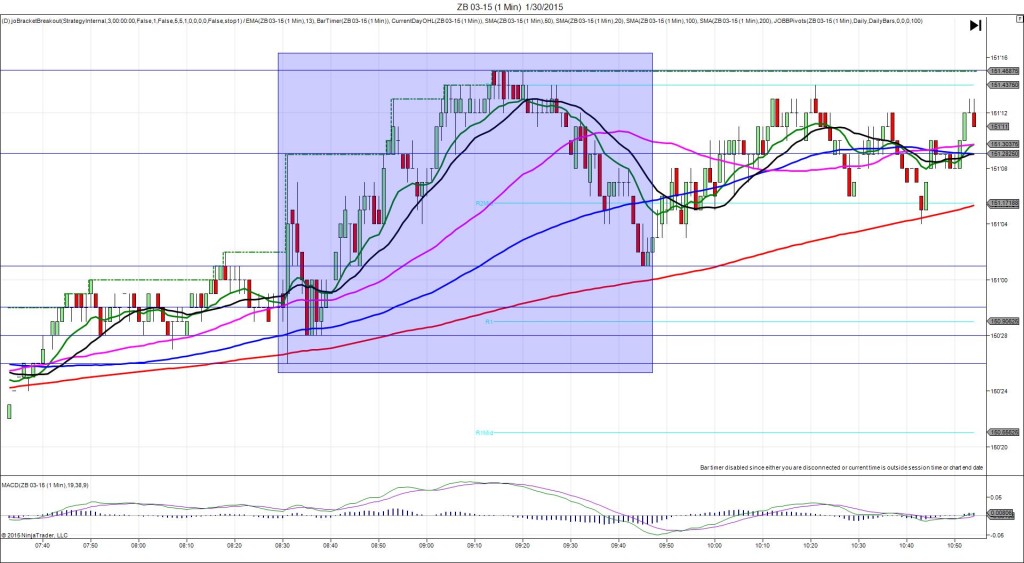

TRAP TRADE (SPIKE WITH 2ND PEAK)

Anchor Point @ 134’01 (last price)

————

Trap Trade:

)))1st Peak @ 134’14 – 0830:06 (1 min)

)))13 ticks

)))Reversal to 134’08 – 0830:47 (1 min)

)))-6 ticks

————

2nd Peak @ 134’20 – 0835 (5 min)

19 ticks

Reversal to 134’08 – 0848 (18 min)

12 ticks

Trap Trade Bracket setup:

Long entries – 133’23 (just below the S2 Mid Pivot) / 133’16 (just below the S2 Pivot)

Short entries – 134’10 (in between the PP and R1 Mid Pivots) / 134’18 (just above the HOD)

Notes: Report came in strongly disappointing as it fell short by 1.1% of an already anemic forecast. This caused a large long spike of 13 ticks that crossed all 3 Major SMAs, the R1 Mid Pivot and the OOD. This would have filled the inner short tier at 134’10, then allowed an exit near breakeven as it hovered later in the bar between 1 tick of heat and 1 tick of profit. Due to the strong results it would be wise to exit quickly when it fell back to the fill point. After the reversal, it climbed for another 6 ticks for a 2nd peak that reached the R1 Pivot. If you were still open in the trade or left the outer tier pending, it would have filled on the 2nd peak and then allowed for a nice profit on the ensuing reversal of 12 ticks in the next 13 min.