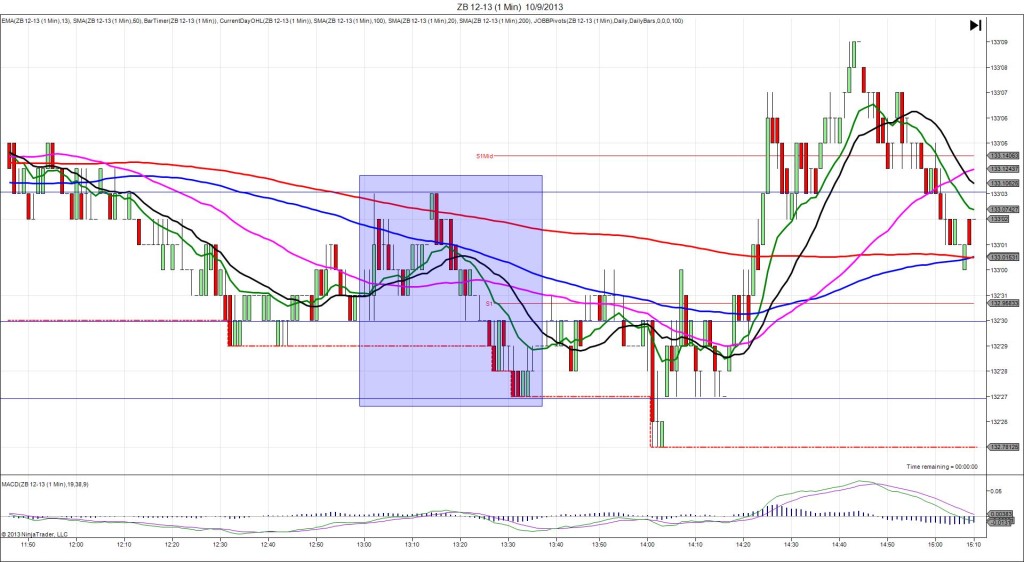

09/26/2013 7-yr Bond Auction (1301 EDT)

Previous: 2.22/2.4

Actual: 2.06/2.5

SPIKE / REVERSE

Started @ 133’03 (1301)

1st Peak @ 132’29 – 1302 (1 min)

6 ticks

Reversal to 133’07 – 1341 (40 min)

10 ticks

Notes: Report is not found on Forex Factory, but the spike always breaks about 1:30 min late as with other bond auctions. The highest yield of 2.06 fell quite a bit from last month. This caused a quick short spike of 6 ticks that bottomed 1 tick above the LOD within 5 sec, then hovered for about 2 min. With JOBB, you would have filled short at 133’01 with no slippage, then seen it hover with about 3 ticks of profit. With the tight trading range before the report and the LOD / S2 Mid Pivot just below the lowest point of the spike, look to exit on the :03 or :04 bars with 2-3 ticks. After the spike it retreated up to the SMAs and eventually broke through, reaching the S1 Mid Pivot 40 min later for 10 ticks.