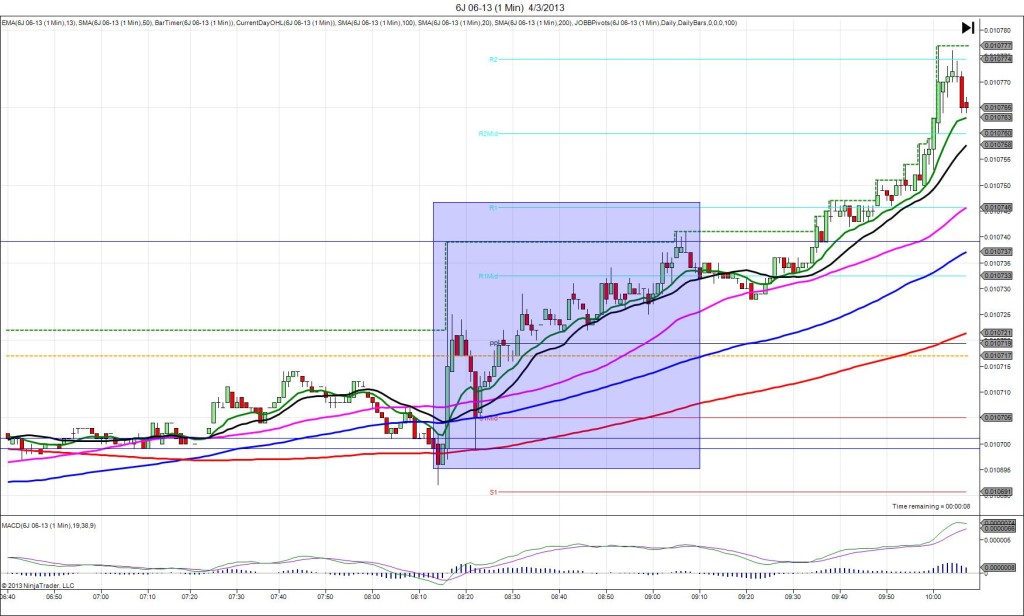

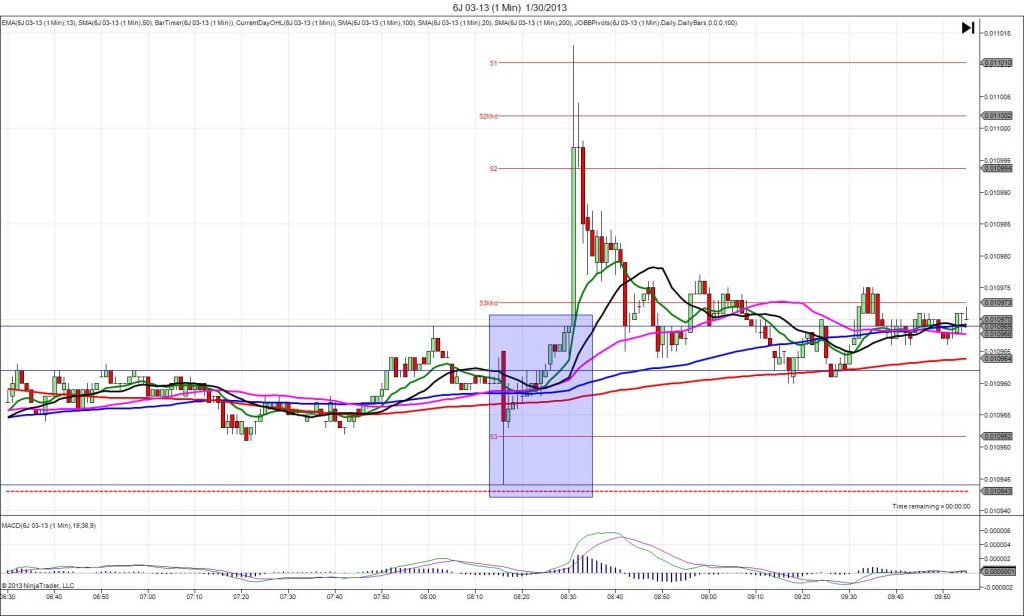

5/22/2013 Weekly Crude Oil Inventory Report (1030 EDT)

Forecast: -0.4M

Actual: -0.3M

SPIKE WITH 2ND PEAK

Started @ 95.75

1st Peak @ 95.27 – 1031 (1 min)

48 ticks

Final Peak @ 94.37 – 1056 (26 min)

138 ticks

Reversal to 95.19 – 1115 (45 min)

82 ticks

Notes: Nearly matching result on the crude, while gasoline saw a healthy gain. Commercial oil inventories continue to be categorized as above their upper limit at record levels. The small change in crude, the large inventory, and the gains in gasoline drove the short move of 48 ticks in 1 min that eclipsed all 3 major SMAs and the S2 Mid Pivot. With JOBB and a 10 tick buffer, you would have filled short at about 95.61 with 4 ticks of slippage. Look to exit in between the 100 SMA and S2 Mid Pivot for about 25 ticks. After the 1st peak, it reversed back to the area of the 100/50 SMAs briefly, then continued to fall also due to the rising dollar on Chmn Bernanke’s testimony. It achieved a final peak of 90 more ticks 25 min later to eclipse the S3 Mid Pivot. Then it reversed back up for 82 ticks to the 100 SMA in the next 20 min.