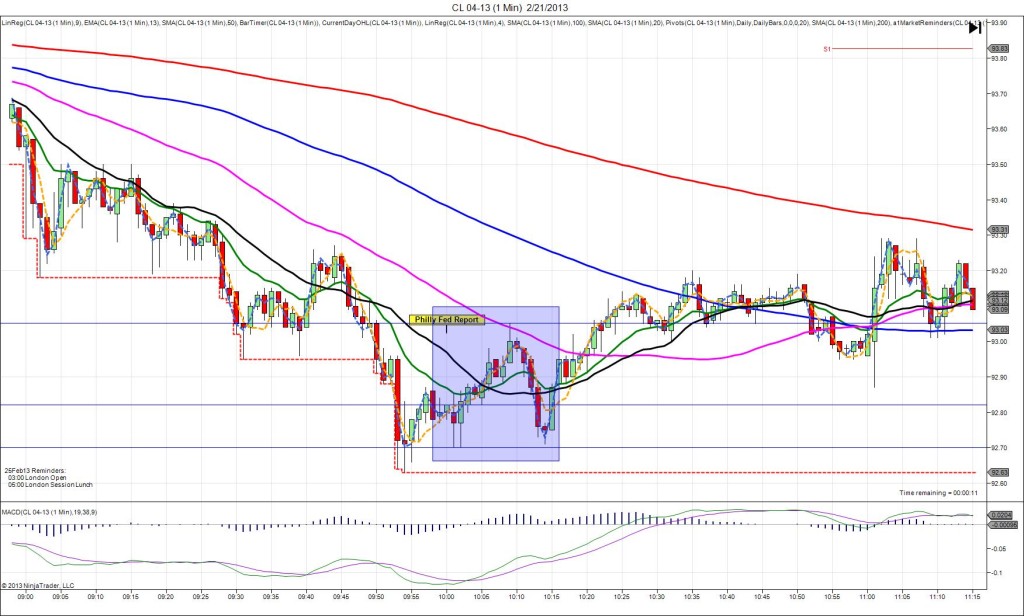

5/3/2013 Monthly Unemployment Report (0830 EDT)

Non Farm Jobs Forecast: 146K

Non Farm Jobs Actual: 165K

Previous Revision: +50K to 138K

Rate Forecast: 7.6%

Rate Actual: 7.5%

SPIKE WITH 2ND PEAK

Started @ 149’05

1st Peak @ 148’05 – 0831 (1 min)

32 ticks

2nd Peak @ 147’24 – 0848 (18 min)

45 ticks

Reversal to 148’01 – 0911 (41 min)

9 ticks

Final Peak @ 147’07 – 1027 (117 min)

62 ticks

Reversal to 147’14 – 1051 (141 min)

7 ticks

Notes: Moderately positive report showing 19K more jobs created than expected, a strong previous upward revision of 50K jobs, and a 0.1% improvement in the unemployment U-3 rate due to shrinkage of the labor force and small gains. This caused the bonds to selloff for 32 ticks on the :31 bar, crossing all 3 major SMAs near the origin, then bottoming just below the S2 Pivot. With JOBB, you would have filled short at about 148’30 with 3 ticks of slippage. Then you would have had an opportunity to capture about 20-24 ticks on the :31 bar, or up to 33 ticks on the :37 bar at the S3 Mid Pivot. I exited just below the S2 Pivot on the :31 bar for 22 ticks. Remember, all reports except 1 on the ZB have achieved 2nd peaks, so being patient and waiting for a target level if it did not initially fill is a safe move. After the peak, it reversed minimally for 7 ticks on the :32 bar, then fell again for a 2nd peak of 13 more ticks in 17 min. Then it reversed for 9 ticks in about 20 min to the 50 SMA. Eventually the final peak fell to 147’07 about 2 hrs after the report, just above the S4 Mid Pivot, then a small reversal yielded 7 ticks in 24 min. This established a strong bearish sentiment in the ZB, not wanting to correct much and continuing to carve out new lows. Another amazing trade on the ZB!