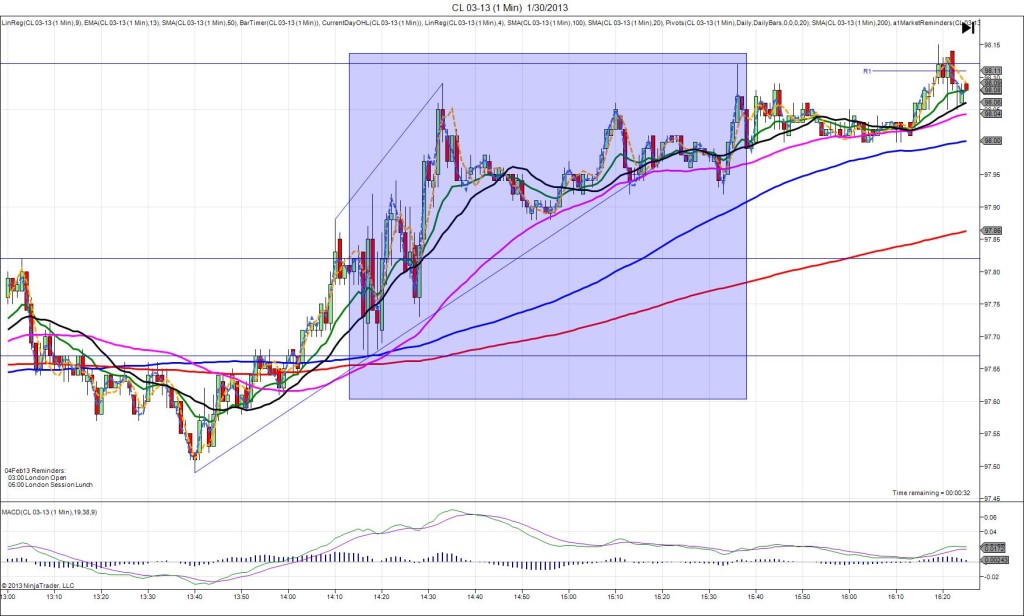

1/30/2013 FOMC Statement / FED Funds Rate (1415 EST)

Forecast: n/a

Actual: n/a

SPIKE/REVERSE

Started @ 97.82 (1415)

1st Peak @ 97.67 – 1417 (2 min)

15 ticks

Reversal to 97.92 – 1418 (3 min)

25 ticks

Notes: Report released on time, as the FED chose to continue the existing open ended QE3 policy despite seeing certain indications of improving economic conditions. This caused both the CL and the DX to seesaw changing sentiment every minute such that it went short 15 ticks, then long 25, then repeated the trend. Over the longer term it trended mildly higher using the 50 SMA as support and eventually the R1 Pivot as resistance. After hearing the news and seeing the reaction in the first 5 minutes, it would be safe to buy the dips, using the major SMA cluster at 97.67 as your stop loss area. Sell the rips when it moves about 25 ticks away from the 50 SMA. You could have done that once or twice in the hour following the report.