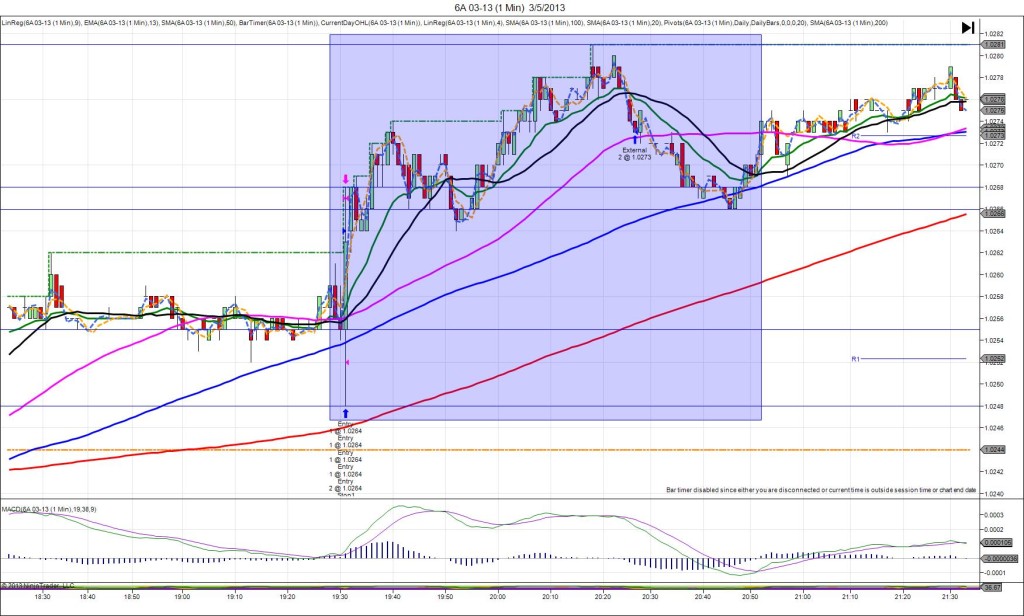

3/5/2012 Quarterly Advance GDP (1930 EST)

Forecast: 0.6%

Actual: 0.6%

Previous Revision: +0.2% to 0.7%

INDECISIVE

Started @ 1.0255

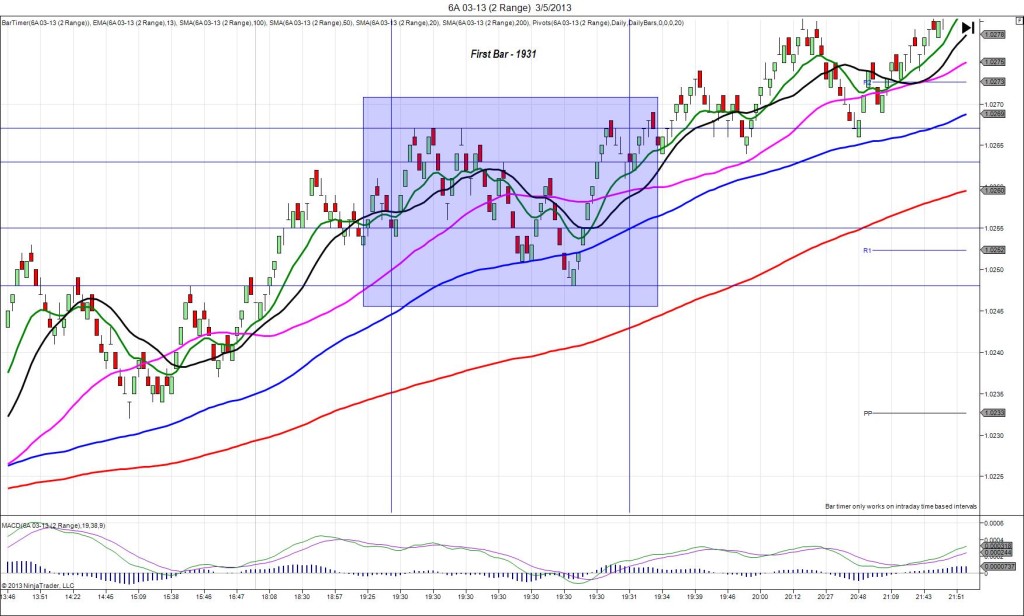

1st Peak@ 1.0268 – 1931 (1 min)

13 ticks

Reversal to 1.0248 – 1931 (1 min)

-20 ticks

Settle @ 1.0263 – 1931 (1 min)

8 ticks

Final Peak @ 1.0281 – 2018 (48 min)

36 ticks

Reversal to 1.0266 – 2045 (75 min)

15 ticks

Notes: Report matched the forecast with a moderate upward previous revision. This caused an indecisive reaction when a large quarterly report with impact came in as expected. With the market trending upward before the report, the initial spike went long for 13 ticks, then reversed short for 20 ticks to cross the 50/100 SMAs and the R1 Pivot, then pulled back long to settle 8 ticks above the origin. With JOBB, you would have filled long at 1.0264 with 4 ticks of slippage. Then you would have been stopped out immediately on the reversal for a 15 tick loss. After the :31 bar settled, it achieved a slow developing final peak of 36 total ticks about 45 min later to extend the HOD and cross the R2 Pivot. Then the reversal fell 15 ticks in the next 25 min back to the 100 SMA.