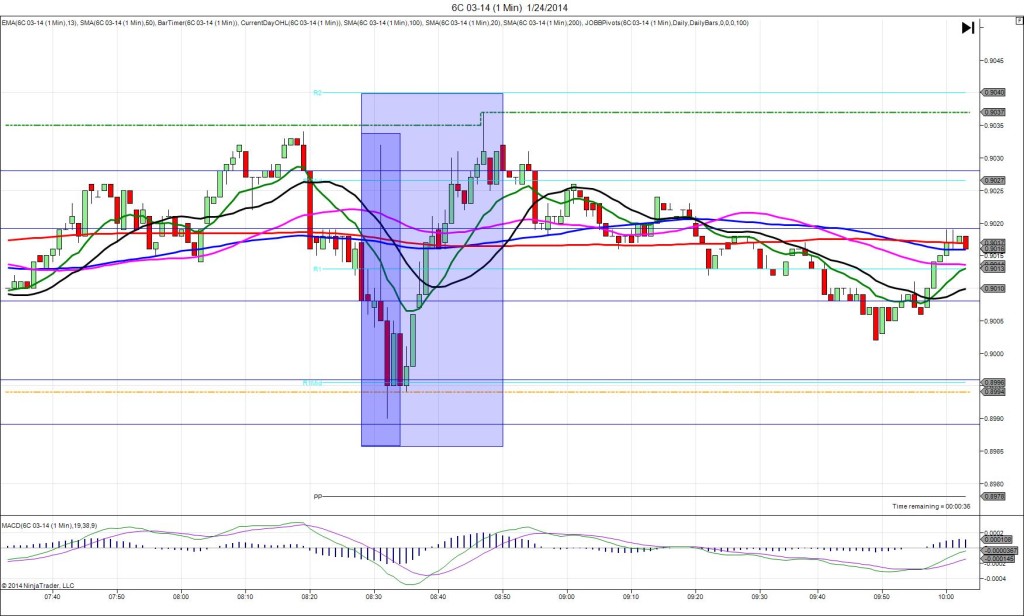

1/24/2014 Monthly Core CPI / CPI Report (0830 EST)

Core CPI Forecast: -0.4%

Core CPI Actual: -0.4%

Previous Revision: n/a

CPI Forecast: -0.2%

CPI Actual: -0.2%

Previous Revision: n/a

TRAP TRADE

Anchor Point @ 0.9008 (last price)

—————-

Trap Trade:

)))1st peak @ 0.9032 – 0830:04 (1 min)

)))24 ticks

)))Reversal to 0.9016 – 0830:11 (1 min)

)))-16 ticks

)))Extended Reversal to 0.8990 – 0831:50 (2 min)

)))-42 ticks

—————-

2nd Peak @ 0.9037 – 0847 (17 min)

29 ticks

Trap Trade Bracket setup:

Long entries – 0.8996 (on the R1 Mid Pivot) / 0.8989 (no SMA/Pivot near)

Short entries – 0.9019 (just above the 100/200 SMAs) / 0.9028 (just above the R2 Mid Pivot)

Notes: Report matched the forecast on the core reading and on the less influential regular CPI reading. This caused an expected indecisive reaction that was large, shooting up 24 ticks to come up just short of the HOD. The long move would have filled both of your short entries and peaked about 4 ticks above the outer tier. Then it would have retreated strongly, giving back 16 ticks in 11 sec and 42 ticks nearly 2 min after the report. Since the report was matching, it can be expected to reverse beyond the origin, so a target around the R1 Mid Pivot would be prudent. With an average short position at about 0.9024, this would allow up to 30 ticks to be captured. After the reversal, it rebounded for a 2nd peak as it hit the HOD 15 min later. Then it drifted lower again in a lazy manner.