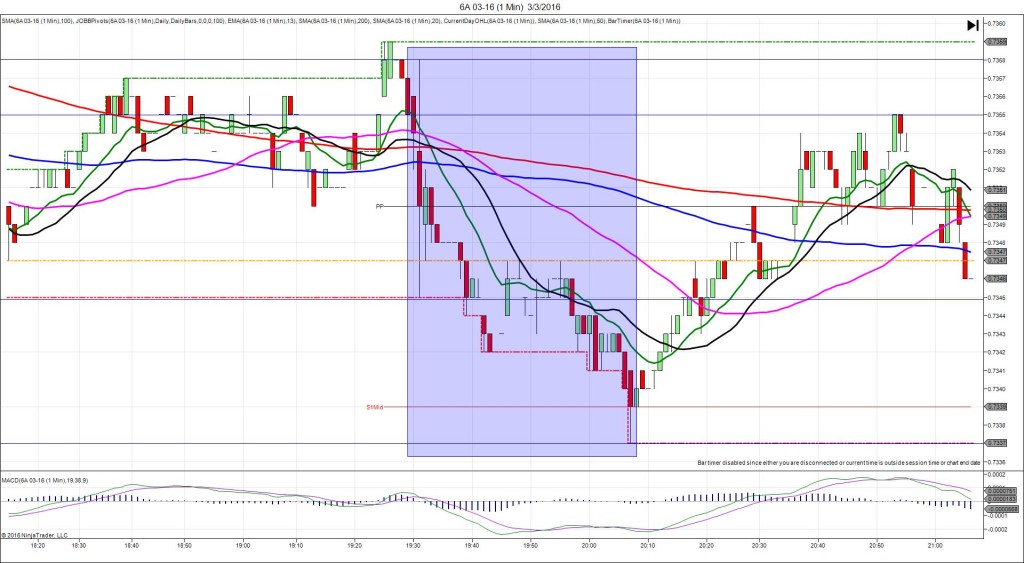

4/3/2016 Monthly Retail Sales (2130 EDT)

Rtl Sales

Forecast: 0.4%

Actual: 0.0%

Previous Revision: n/a

TRAP TRADE – DULL FILL

Anchor Point @ 0.7648

————

Trap Trade:

)))1st Peak @ 0.7630 – 2130:12 (1 min)

)))-18 ticks

)))Reversal to 0.7638 – 2130:15 (1 min)

)))8 ticks

)))Pullback to 0.7628 – 2130:48 (1 min)

)))-10 ticks

————

Reversal to 0.7634 – 2132 (32 min)

6 ticks

Final Peak @ 0.7612 – 2147 (17 min)

36 ticks

Reversal to 0.7623 – 2153 (23 min)

11 ticks

Trap Trade Bracket setup:

Long entries – 0.7636 (just above the LOD) / 0.7627 (No SMA / Pivot near)

Short entries – 0.7659 (in between the R1 Mid Pivot / HOD) / 0.7668 (above the R1 Mid Pivot)

Expected Fill: 0.7636 – inner long tier

Best Initial Exit: 0.7636 – breakeven (0.7634 likely worst case)

Recommended Profit Target placement: 0.7642 – in the middle of the 3 major SMAs

Notes: Strongly bearish Rtl sales results overshadowed the mildly bullish Bldg Approvals to cause a decisive short spike with minimal inclination to reverse. This would have been a dull fill as it would have hovered on your fill point for about 20 sec in the middle of the :31 bar then the PP Pivot held it up for a while before it sought a 2nd peak and fell another 16 ticks.