11/3/2014 Monthly Retail Sales / Trade Balance (1930 EST)

Rtl Sales

Forecast: 0.3%

Actual: 1.2%

Previous Revision: n/a

Trade Bal

Forecast: -1.78B

Actual: -2.26B

Previous Revision: -0.22B to -1.01B

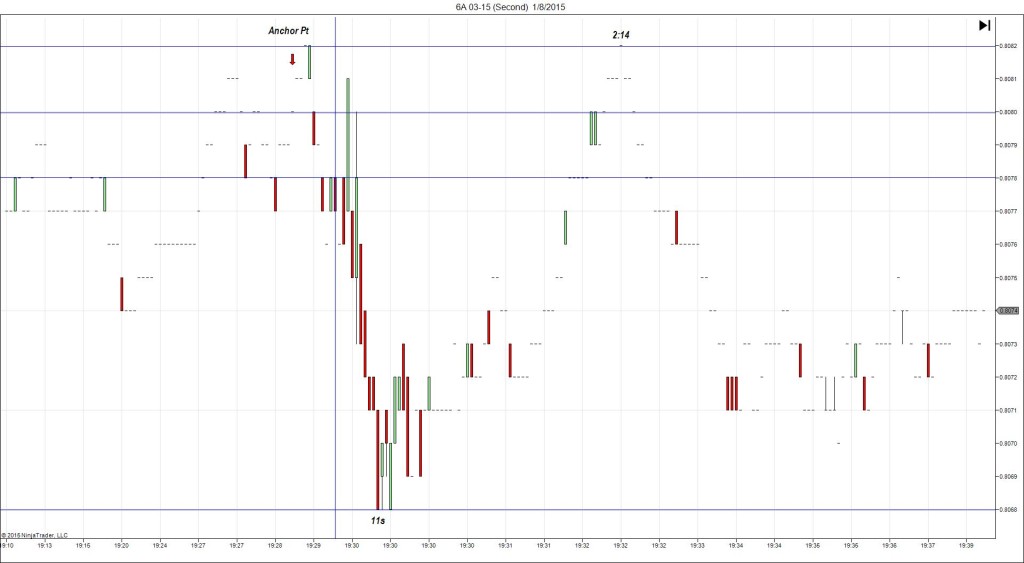

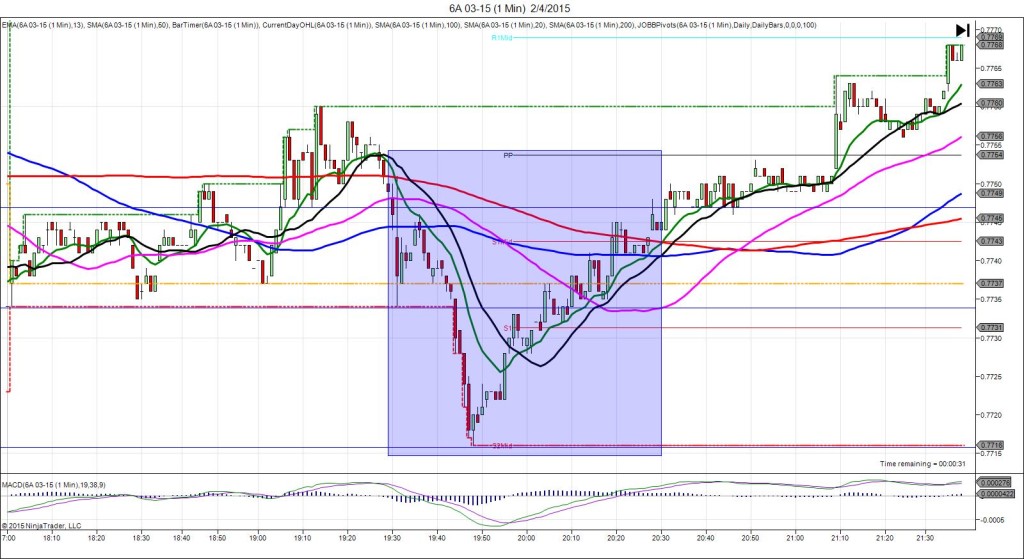

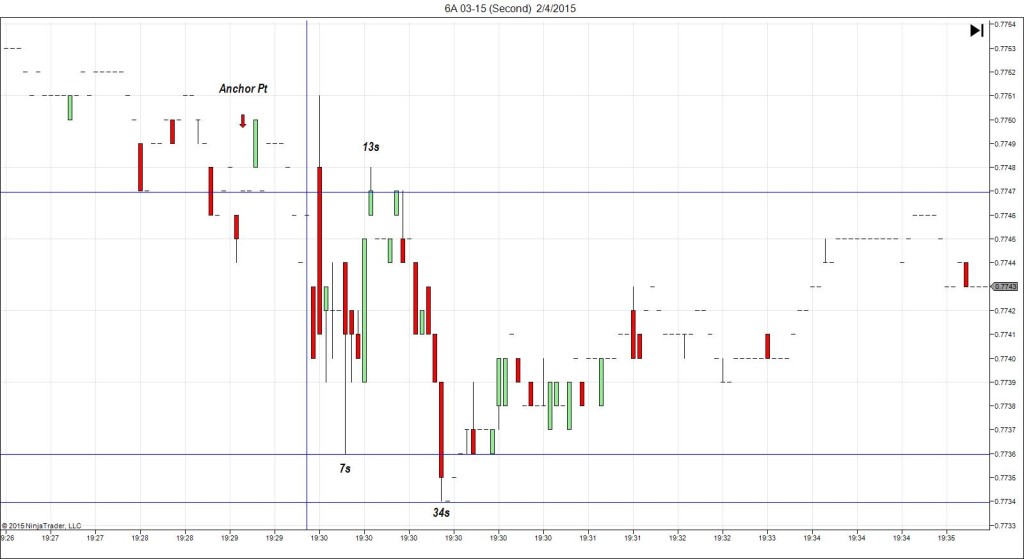

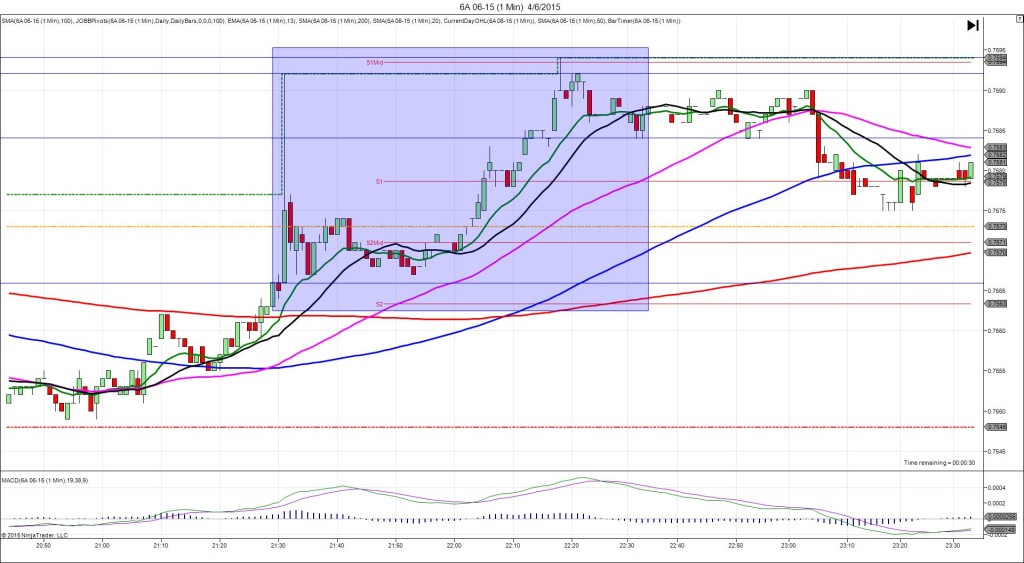

TRAP TRADE – INNER TIER

Anchor Point @ 0.8662 (last price)

————

Trap Trade:

)))1st Peak @ 0.8684 – 1930:03 (1 min)

)))22 ticks

)))Reversal to 0.8672 – 1930:05 (1 min)

)))-12 ticks

)))Pullback to 0.8685 – 1931:03 (2 min)

)))13 ticks

)))Reversal to 0.8663 – 1932:13 (3 min)

)))-22 ticks

————

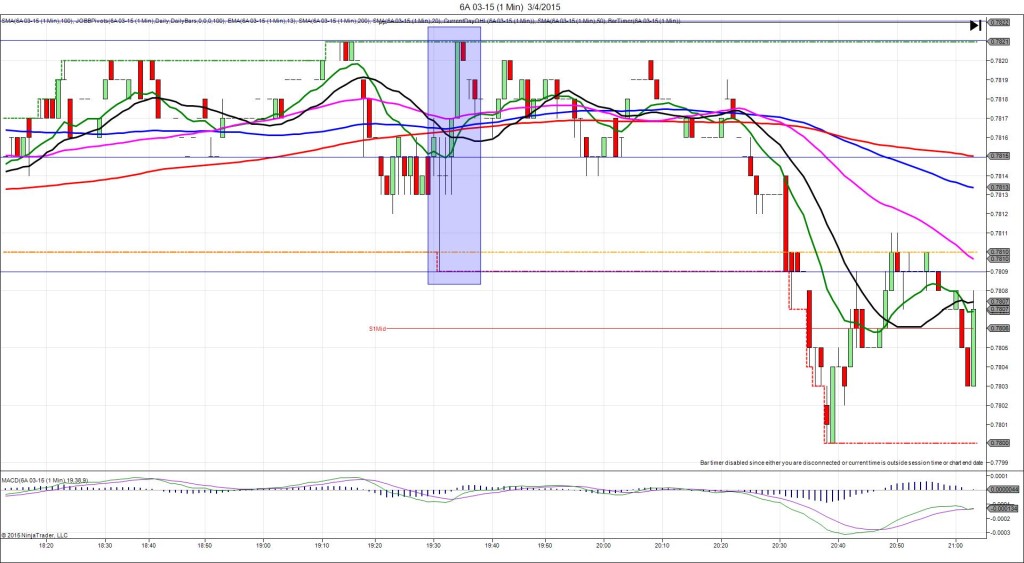

Continued Reversal to 0.8620 – 1940 (10 min)

65 ticks

Pullback to 0.8677 – 2031 (61 min)

57 ticks

Trap Trade Bracket setup:

Long entry – 0.8643 (just below the S1 Pivot)

Short entry – 0.8680 (just above the R1 Mid Pivot)

Notes: Retail Sales report strongly exceeded the forecast with no previous revision while the Trade Balance report fell short of the forecast by nearly 0.5B with a moderate downward previous report revision. This caused a long spike of 22 ticks in 3 sec that rose to cross the R1 Mid Pivot and nearly reach the R1 Pivot then retreat. This would have filled the short entry with about 4 ticks to spare, then quickly backed off and hovered for 6 sec allowing about 6 ticks to be captured. Then it pulled back to hover between the fill point and the R1 Pivot and reversed again as the :32 bar started for 22 ticks into the :33 bar. This would have allowed up to 15 ticks to be captured in the vicinity of the SMAs and OOD. After that it continued to make a dramatic nose dive for another 43 ticks in the next 7 min to the S2 Pivot. Then it pulled back 57 ticks in 51 min to the R1 Pivot.