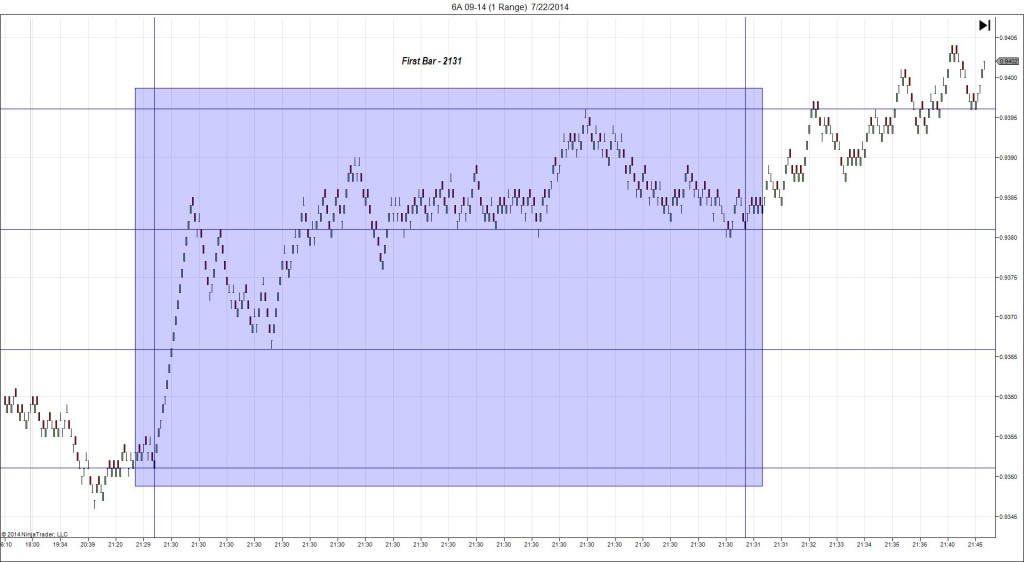

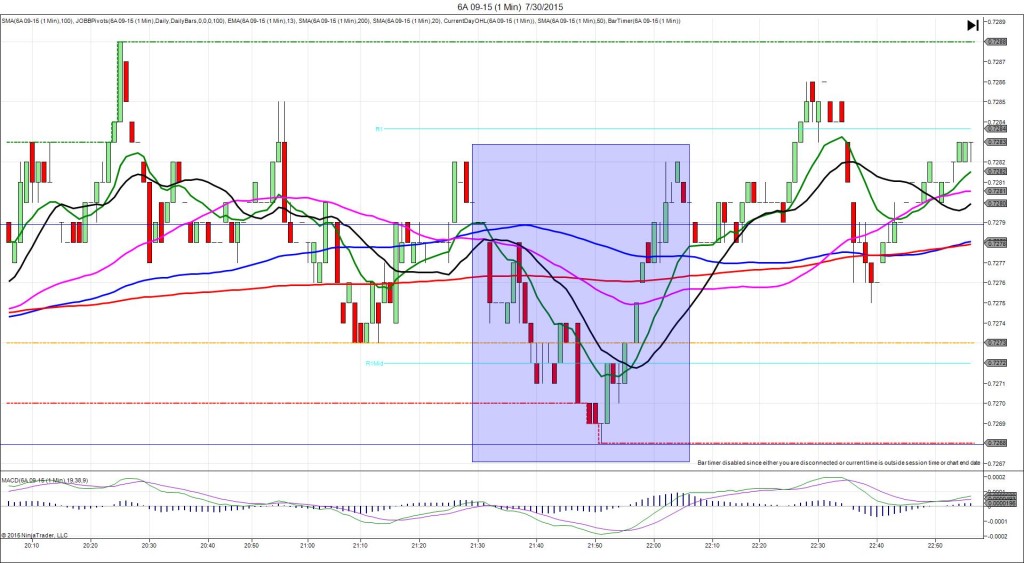

1/7/2015 Building Approvals (1930 EST)

Forecast: -2.7%

Actual: 7.5%

Previous Revision: +0.1% to 11.5%

SPIKE / REVERSE

Started @ 0.8048

1st Peak @ 0.8066 – 1931:18 (2 min)

18 ticks

Reversal to 0.8060 – 1933 (3 min)

6 ticks

2nd Peak @ 0.8068 – 1938 (8 min)

20 ticks

Reversal to 0.8051 – 2000 (30 min)

17 ticks

Double Top @ 0.8068 – 2007 (37 min)

17 ticks

Reversal to 0.8054 – 2033 (63 min)

14 ticks

Notes: Report strongly exceeded the forecast to cause a long spike of 18 ticks that started on the R1 Mid Pivot and rose to cross the R1 Pivot and extend the HOD. It gained 15 ticks in 7 sec, then struggled for the remaining 3 ticks in the next minute. With JOBB and a 3 tick bracket, your long order would have filled at about 0.8055 with 4 ticks of slippage, then allowed about 6 ticks to be captured on a conservative quick exit or about 10 ticks with a target placed just above the R1 Pivot. After a small 6 tick reversal, it climbed for a minor 2nd peak of 2 more ticks in 6 min. After treading water around the R1 Pivot, it reversed 17 ticks in 22 min as it crossed the 50 SMA. Then it climbed for a double top in 7 min followed by reversal of 14 ticks to the 100 SMA.