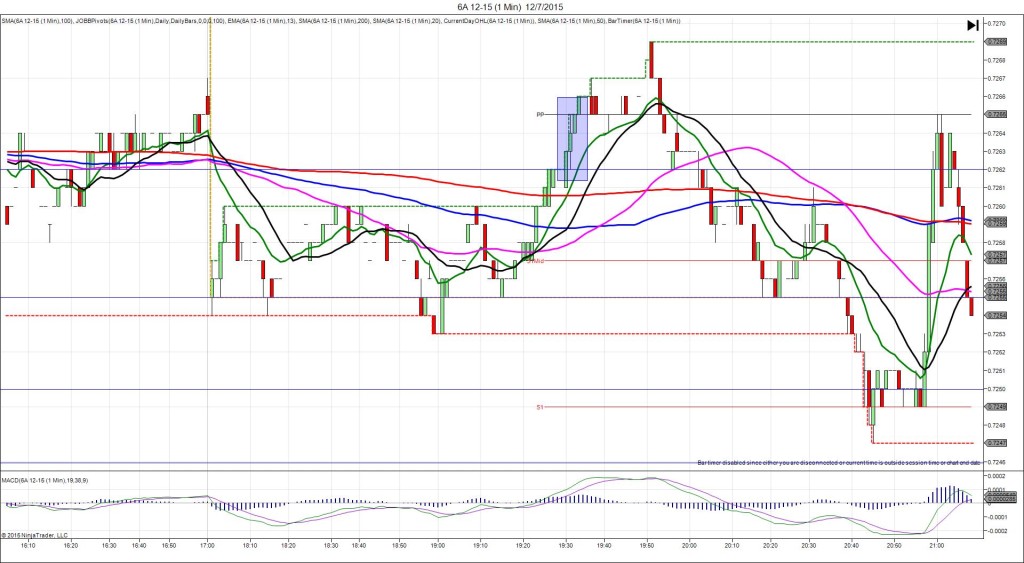

12/2/2015 Monthly Trade Balance (1930 EST)

Forecast: -2.61B

Actual: -3.31B

Previous Revision: -0.08B to -2.40B

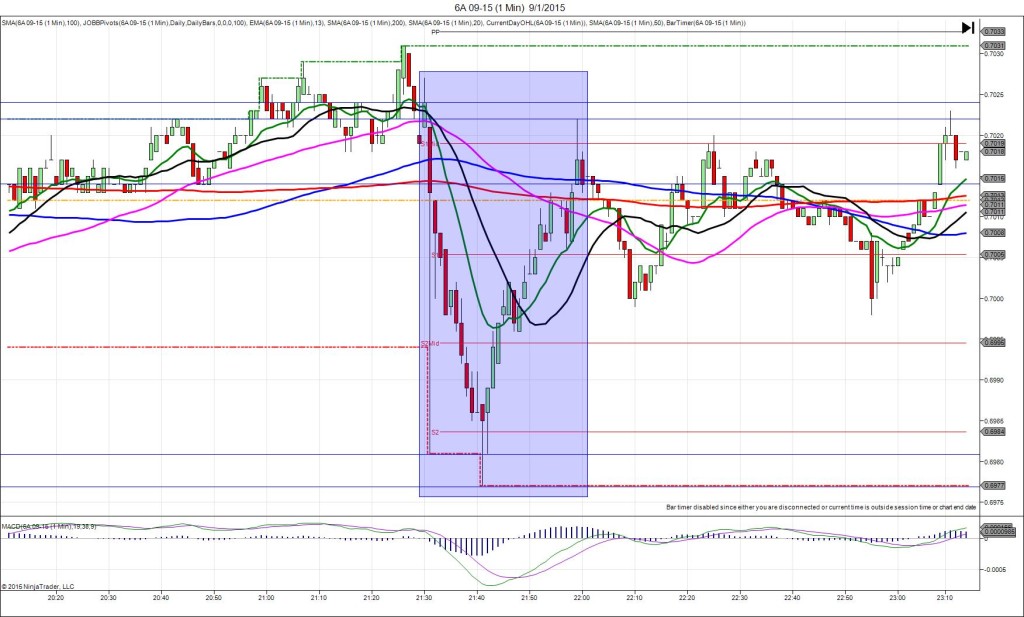

TRAP TRADE – OUTER TIER

Anchor Point @ 0.7295

————

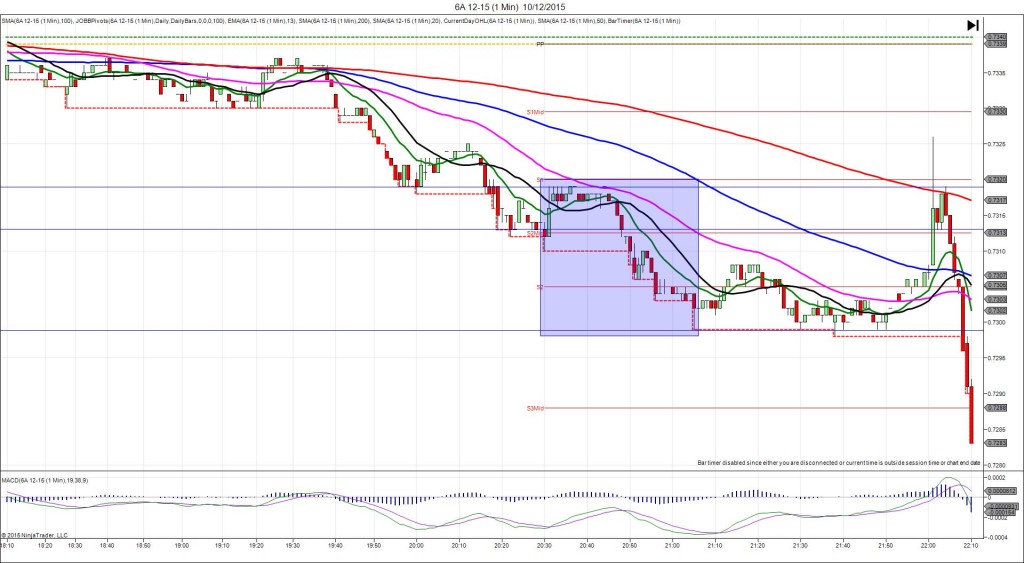

Trap Trade:

)))1st Peak @ 0.7282 – 1930:03 (1 min)

)))-13 ticks

)))Reversal to 0.7289 – 1930:08 (1 min)

)))7 ticks

————

Pullback to 0.7281 – 1937 (7 min)

)))8 ticks

Reversal to 0.7288 – 1955 (25 min)

7 ticks

Continued Reversal to 0.7305 – 2139 (129 min)

24 ticks

Trap Trade Bracket setup:

Long entries – 0.7287 (No SMA / Pivot near / 0.7280 (below the S1 Pivot)

Short entries – 0.7302 (just above the HOD) / 0.7310 (No SMA / Pivot near)

Expected Fill: 0.7287 – inner long tier

Best Initial Exit: 0.7289 – 2 ticks

Recommended Profit Target placement: 0.7295 (just above the S1 Mid Pivot) – move lower

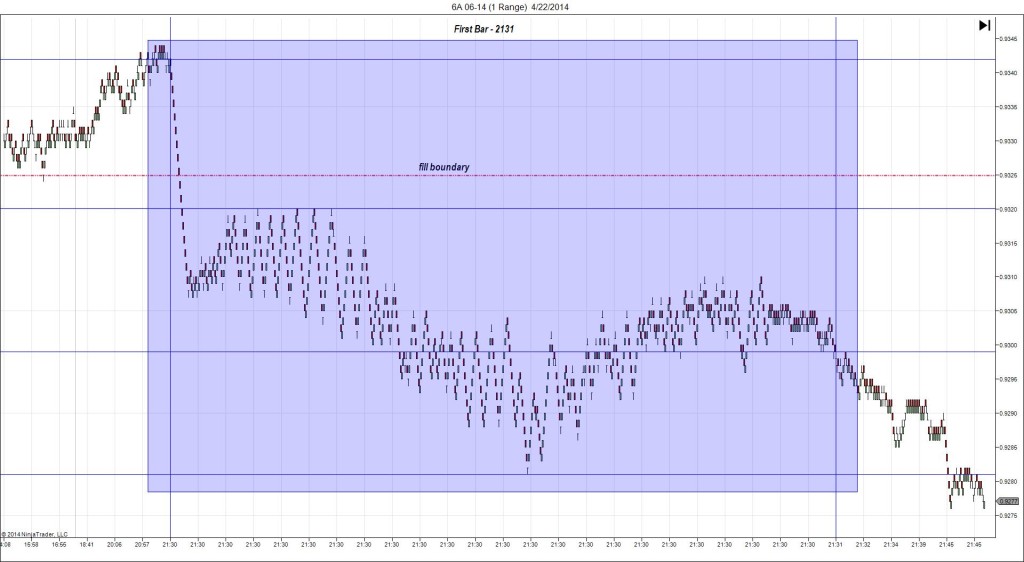

Notes: Spike was just short of the outer tier by 2 ticks, then did not reverse much. This scenario is rare, but look to exit near breakeven.