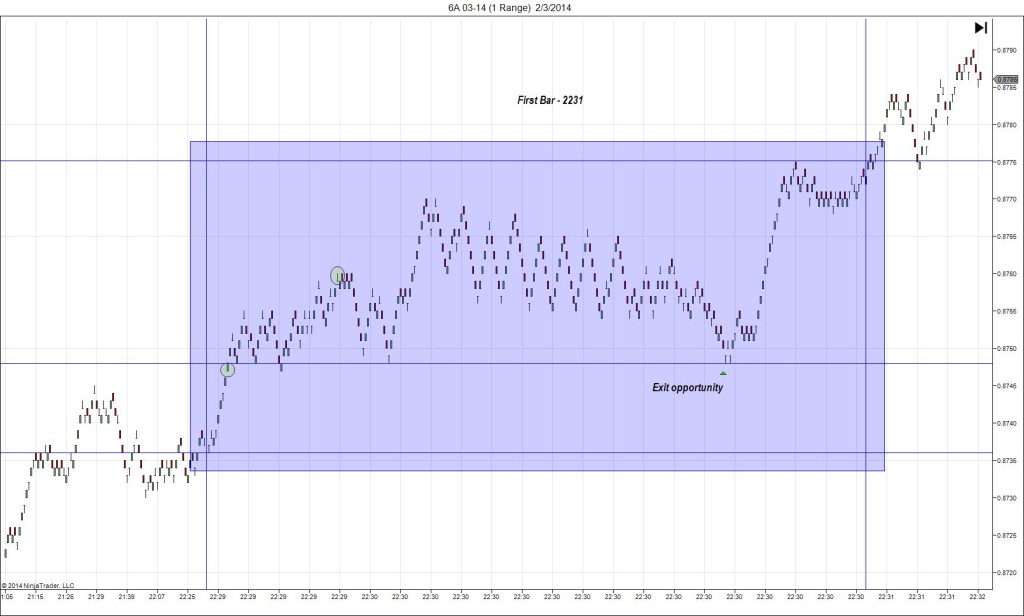

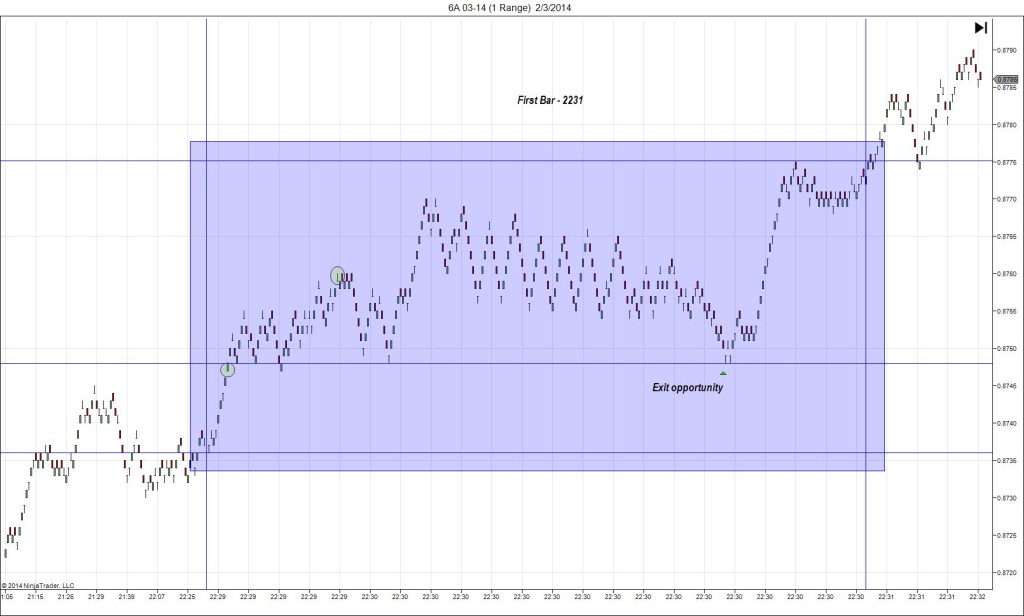

2/3/2014 RBA Rate Statement / Cash Rate (2230 EST)

Forecast: 2.50%

Actual: 2.50%

TRAP TRADE (STOPPED OUT)

Started @ 0.8736 (last price)

————

Trap Trade:

)))1st Peak @ 0.8760 – 2229:59 (0 min)

)))24 ticks

)))Reversal to 0.8748 – 2230:01 (1 min)

)))-12 ticks

)))Pullback to 0.8770 – 2230:03 (1 min)

)))22 ticks

)))Reversal to 0.8748 – 2230:28 (1 min)

)))-22 ticks

————

2nd Peak @ 0.8804 – 2233 (3 min)

68 ticks

Final Peak @ 0.8870 – 2335 (65 min)

134 ticks

Reversal to 0.8848 – 2344 (74 min)

22 ticks

Trap Trade Bracket setup:

Long entries – 0.8724 (below the OOD and on the 200 SMA) / 0.8714 (no SMA/Pivot within 5 ticks)

Short entries – 0.8747 (just above the HOD) / 0.8759 (just above the PP Pivot)

Notes: Australia’s central bank left rates unchanged as expected, however the RBA signaled that interest rate cuts are at an end while omitting mention of an “uncomfortably high” exchange rate that was in the previous 2 statements. This caused a very large and decisive bullish move that unfortunately was not a good setup for the Trap Trade. The initial burst long would have filled both tiers of the short orders, then seen another 11 ticks of heat. It backed off to yield only 5 ticks of profit from the average position 28 sec into the :31 bar. With this report it would be prudent to move the stop loss tighter with the strong bullish reaction and exit near break even before it continued higher. If not, you would have been stopped out for a 15 tick loss. The final peak achieved a total of 134 ticks in the next hour in a dramatic upward fan that crossed the R2 Pivot, then it reversed for 22 ticks in the next 9 min back to the R2 Pivot.