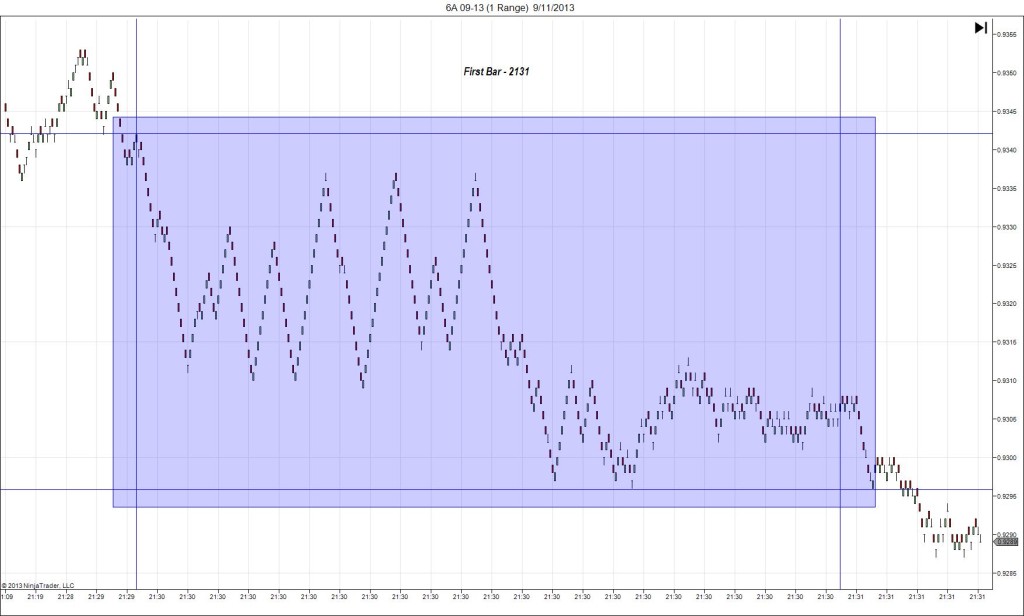

11/18/2013 RBA Monetary Policy Meeting Minutes (1930 EST)

Forecast: n/a

Actual: n/a

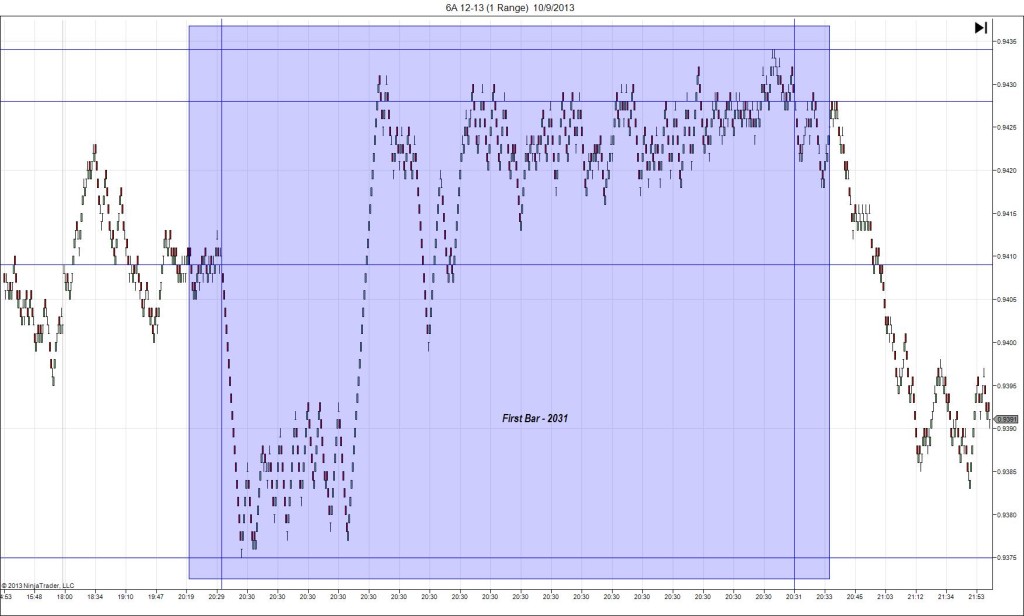

TRAP TRADE

Started @ 0.9349

—————-

Trap Trade:

)))1st peak @ 0.9336 – 1930:11 (1 min)

)))-13 ticks

)))Reversal to 0.9348 – 1930:48 (1 min)

)))12 ticks

)))Pullback to 0.9336 – 1931:20 (2 min)

)))-12 ticks

—————-

Reversal to 0.9366 – 1938 (8 min)

30 ticks

Pullback to 0.9354 – 1950 (20 min)

12 ticks

Notes: Minutes caused a short reaction that fell 13 ticks 11 sec into the :31 bar, then reversed back to the origin after 48 sec before a pullback to double bottom 20 sec into the :32 bar. The drop nearly reached the S1 Pivot. 10 ticks was the recommended offset. So with an anchor point of about 0.9349 as the centerline of trading in the last 30 min, the HOD at 0.9358 is a good point for the short entry, and with no indicator near 7-10 on the short side, just go with 9-10 ticks at 0.9340 for the long entry. The long entry would have filled with 4 ticks of space, then backed off to give 8 ticks of profit for easy capture. It fell again, but then reversed to give 20+ ticks profit on a patient exit near the HOD. Then it pulled back to the 100/200 SMAs for 12 ticks. After that it rallied to step higher near the PP Pivot.