11/11/2013 NAB Business Confidence (1930 EST)

Forecast: n/a

Actual: 5

DOWNWARD FAN

Started @ 0.9347

1st Peak @ 0.9320 – 1934 (4 min)

27 ticks

2nd Peak @ 0.9315 – 1949 (19 min)

32 ticks

Reversal to 0.9331 – 2001 (31 min)

16 ticks

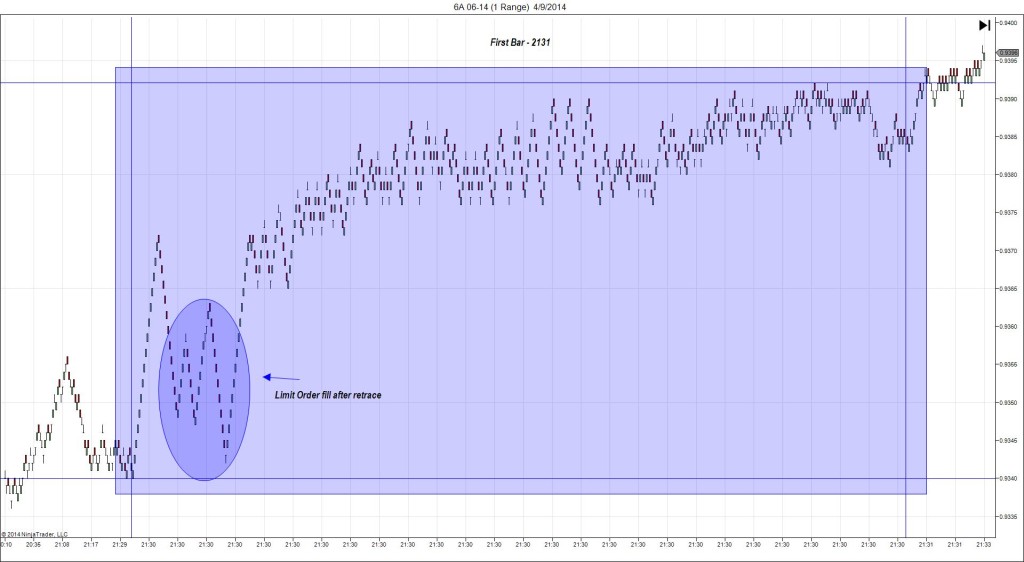

Final Peak @ 0.9304 – 2131 (121 min)

43 ticks

Reversal to 0.9312 – 2146 (136 min)

8 ticks

Notes: Report came in much less than the previous month to cause a short move of 27 ticks over the :31 – :34 bars that started on the HOD and fell to cross all 3 major SMAs and eclipse the S1 Pivot while extending the LOD. Once again the move was slow and tame resulting in a fill with low slippage. The S1 Mid Pivot would have been a safe and conservative exit for about 10-12 ticks. After the peak, it struggled with the S1 Pivot for about 15 min, then reversed for 16 ticks back to the 50 SMA / S1 Mid Pivot. Then it proceeded to take slow and progressive steps lower in a downward fan that used the 50 SMA as resistance and eventually crossed the S2 Mid Pivot about 2 hrs after the report. Then it reversed for 8 ticks in 15 min.